The FY25 Domain Price Forecast report provides a detailed analysis of projected changes in house and unit prices across various regions in Australia. The projections reflect the complex interplay of upward and downward drivers that are expected to shape the housing market over the next financial year.

Projected Price Changes

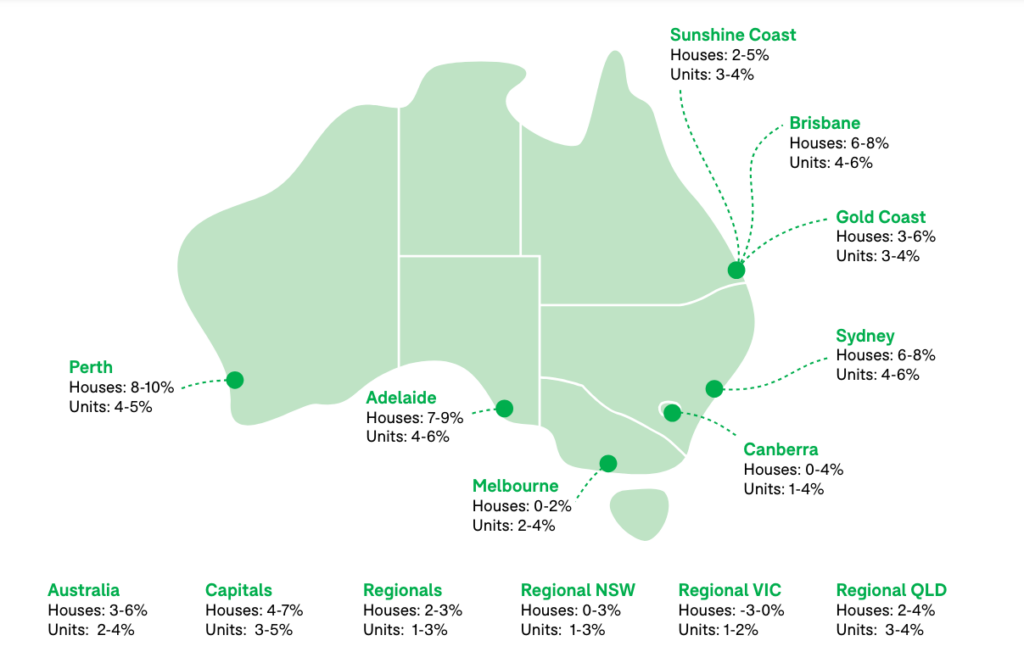

According to the report, the overall housing market in Australia is expected to see moderate growth in FY25. Nationally, house prices are projected to increase by 3-6%, while unit prices are forecasted to rise by 2-4%. This trend varies significantly across different regions and cities, reflecting localized market dynamics and economic conditions.

In the capital cities, house prices are expected to grow by 4-7%, and unit prices by 3-5%. Specific cities show varying growth rates, with Perth leading the forecast with an anticipated house price increase of 8-10% and unit prices rising by 4-5%. Adelaide follows closely, with house prices projected to rise by 7-9% and unit prices by 4-6%. On the other hand, Melbourne is expected to see more modest growth, with house prices increasing by 0-2% and unit prices by 2-4%.

In regional areas, the growth is generally more subdued. Regional New South Wales (NSW) and Queensland (QLD) are expected to see house prices rise by 0-3% and 2-4%, respectively. Unit prices in these regions are forecasted to grow by 1-3% and 3-4%, respectively. However, regional Victoria (VIC) is an outlier, with house prices anticipated to decrease by 3-0%, although unit prices may still see a slight increase of 1-2%.

Here is a table summarising the projected price changes by region:

| Region | House Price Growth (%) | Unit Price Growth (%) |

|---|---|---|

| Australia | 3-6 | 2-4 |

| Capitals | 4-7 | 3-5 |

| Regionals | 2-3 | 1-3 |

| Regional NSW | 0-3 | 1-3 |

| Regional VIC | -3-0 | 1-2 |

| Regional QLD | 2-4 | 3-4 |

| Perth | 8-10 | 4-5 |

| Adelaide | 7-9 | 4-6 |

| Melbourne | 0-2 | 2-4 |

| Brisbane | 6-8 | 4-6 |

| Sunshine Coast | 2-5 | 3-4 |

| Canberra | 0-4 | 1-4 |

| Sydney | 6-8 | 4-6 |

| Gold Coast | 3-6 | 3-4 |

Upward Price Drivers

Several factors are driving the anticipated increases in house and unit prices. Population growth is a significant upward driver, as demand has escalated due to demographic shifts, changes in household composition, and strong population growth. The rise in single-person households and a decrease in average household size have intensified housing demand, compounded by significant migration. Despite attempts to cap migration, current levels remain high, driven by the need to avoid skill shortages and mitigate the high cost of living.

Another critical factor is the construction headwinds facing the housing market. Limited supply, due to land scarcity, weak building approvals, and high construction costs, is expected to positively influence home prices. The construction sector has struggled to keep up with population growth, with increased costs for materials and wages, as well as supply-chain bottlenecks, further hampering supply. To stimulate new home construction, either building costs must decrease, or existing home prices must rise.

Borrowing power is also expected to boost the housing market. Stage 3 tax cuts, effective from July 1, will increase household incomes, enhancing borrowing capacity and buying power across the country. Additionally, a potential interest rate cut anticipated mid-FY25 could further increase borrowing power, providing additional momentum to the housing market.

Downward Price Drivers

However, several factors could exert downward pressure on housing prices. Income stagnation is a significant concern, as living costs have risen faster than wages, resulting in declining real incomes. This makes it harder for potential buyers to save and afford homes, especially with house prices having risen substantially in recent years. Stagnant wage growth and high house prices will continue to stretch affordability and dampen demand.

Rising unemployment poses another risk. The unemployment rate, which had hit a low of 3.5% in 2022, increased to 4% in May 2024 and is forecasted to rise to 4.5% in FY25. Higher unemployment rates will dampen housing demand as more people face financial difficulties, delaying or preventing property purchases. This could lead to an increase in mortgage arrears and distressed sales, particularly in city mortgage belts.

Consumer sentiment also plays a crucial role. Pessimistic consumer sentiment, exacerbated by high inflation and interest rates, may further dampen housing turnover. Despite efforts in the FY25 federal budget to relieve cost-of-living pressures, sustained high interest rates and sticky inflation could continue to negatively impact consumer sentiment. Potential buyers may delay purchasing properties for fear of financial stress or an inability to service mortgages if living costs continue to rise.

What Does It All Mean?

The FY25 Domain Price Forecast highlights a mixed outlook for the Australian housing market, with various factors driving both upward and downward price pressures. While population growth, limited construction supply, and increased borrowing power are expected to drive prices up, income stagnation, rising unemployment, and negative consumer sentiment could exert downward pressure. As the housing market navigates these dynamics, potential buyers and investors should remain informed about these influencing factors to make well-rounded decisions.