Key Takeaways

The latest ANZ-Roy Morgan Consumer Confidence report reveals that consumer sentiment in Australia remains largely unchanged in mid-July 2024. Here are the main takeaways:

- Consumer Confidence index stands at 78.5

- The index has spent a record 76 consecutive weeks below 85

- Current confidence is 5.9 points above the same week in 2023

- However, it's 3.1 points below the 2024 weekly average of 81.6

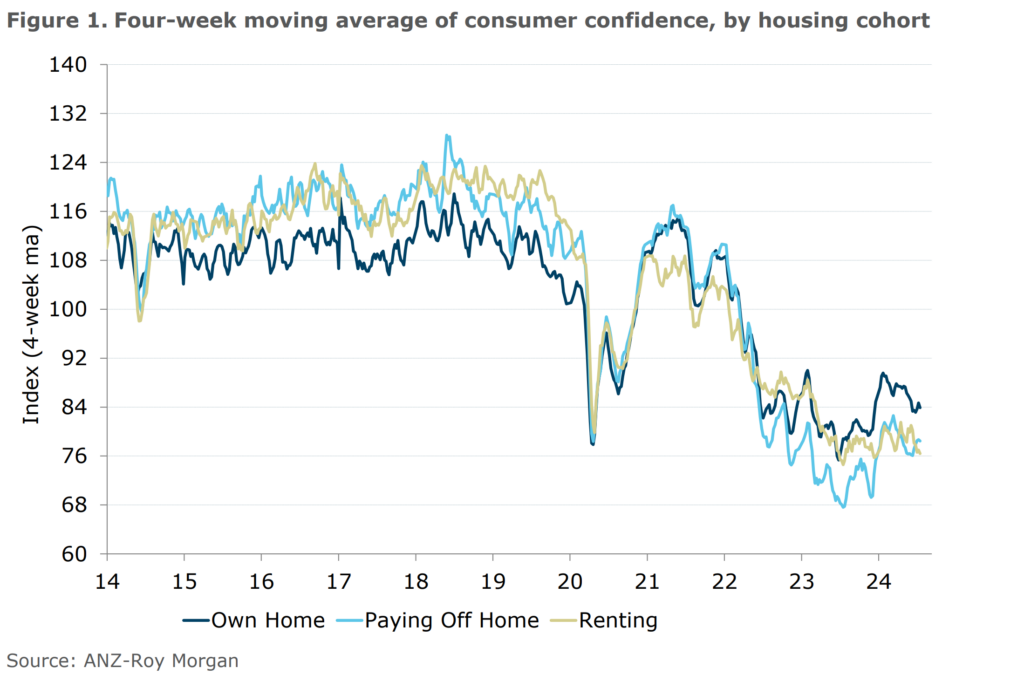

- Not surprisingly, those who own their home are more confident than mortgage holders and renters

- Persistently low consumer confidence leads to reduction in spending, creating a negative feedback loop that worsens conditions

Understanding Consumer Confidence

Consumer confidence is a crucial economic indicator that measures the degree of optimism that consumers feel about the overall state of the economy and their personal financial situation. This metric is essential for several reasons:

- It provides insight into consumer spending patterns, which drive a significant portion of economic activity.

- It serves as a leading indicator for economic trends, often signalling shifts before they become apparent in other economic data.

- It influences business decisions, particularly in retail and consumer goods sectors.

- It can impact policy decisions by governments and central banks.

When consumer confidence is high, it typically translates into increased consumer spending. Consumers feel more secure about their financial future and are more likely to make major purchases, take on debt, or reduce their savings rate. This increased spending can stimulate economic growth, boost business revenues, and potentially lead to job creation.

Conversely, when consumer confidence is low, as we’re currently seeing in Australia, consumers tend to be more cautious with their spending. They may delay major purchases, increase savings as a precautionary measure, and generally tighten their budgets. This behaviour can lead to a slowdown in economic activity, potentially resulting in reduced business revenues, job losses, and in severe cases, contribute to economic recessions.

State-by-State Analysis

Consumer confidence varied across different states:

- Victoria and Western Australia: Increased

- Queensland and South Australia: Decreased

- New South Wales: Virtually unchanged

These regional variations can be attributed to local economic conditions, job markets, and housing prices, highlighting the importance of targeted economic policies.

Detailed Breakdown of Consumer Sentiment

Current Financial Conditions

- 20% of Australians feel ‘better off’ financially than last year (up 1%)

- 53% feel ‘worse off’ (unchanged)

Future Financial Outlook

- 30% expect to be ‘better off’ financially next year (down 1%)

- 35% expect to be ‘worse off’ (unchanged)

Short-term Economic Confidence

- Only 8% expect ‘good times’ for the Australian economy in the next 12 months

- 37% expect ‘bad times’ (up 1%)

Long-term Economic Outlook

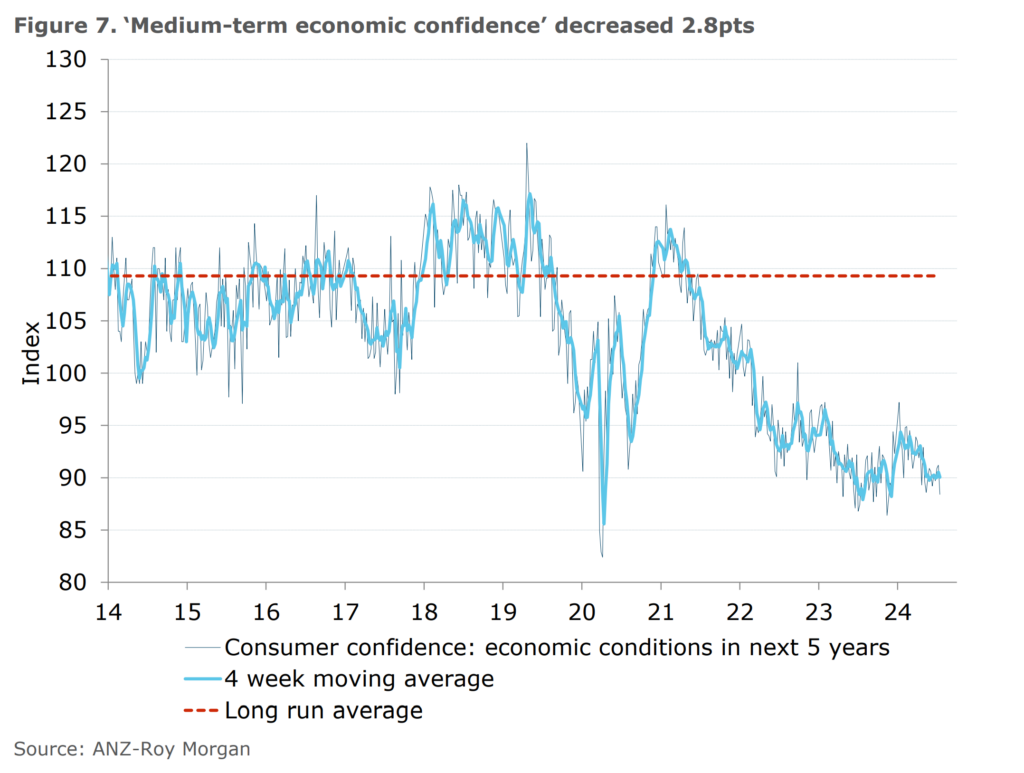

- Long-term views on the economy have dropped to the lowest so far this year

- 10% expect ‘good times’ over the next five years (down 2%)

- 22% expect ‘bad times’ (up 1%)

Consumer Buying Intentions

- 20% believe it’s a ‘good time to buy’ major household items (down 1%)

- 49% say it’s a ‘bad time to buy’ (down 2%)

Expert Commentary

ANZ Economist Madeline Dunk noted:

- Consumer confidence remains soft, with the second weakest result since early December 2023

- The index is currently 36 points lower than its pre-COVID five-year average (2015-2019)

- The ‘time to buy a major household item’ subindex is particularly weak, down 62 points from the pre-COVID average

- Households are very concerned about their current financial position, with this subindex down 41 points relative to the pre-COVID five-year average

Implications of Sustained Low Consumer Confidence

The prolonged period of low consumer confidence in Australia, as indicated by the record 76 consecutive weeks below 85, raises concerns about the broader economic outlook. This sustained pessimism can have far-reaching consequences:

Economic Growth

Persistent low consumer confidence often leads to reduced consumer spending, which can significantly impact economic growth. Consumer spending is a major component of GDP, and when it slows, overall economic growth tends to follow suit. This can create a negative feedback loop, where slower growth further dampens consumer confidence.

Business Impact

Businesses, especially those in retail and consumer goods sectors, may face challenges due to reduced consumer spending. This could lead to:

- Lower sales and revenue

- Reduced profit margins as businesses may need to offer discounts to attract cautious consumers

- Potential job cuts or hiring freezes as businesses try to manage costs

- Delayed or cancelled expansion plans

- Reduced business investment, further slowing economic growth

Labor Market

A prolonged period of low consumer confidence can have adverse effects on the job market:

- Businesses may become more hesitant to hire, leading to slower job creation

- Job security concerns may increase among employed individuals

- Wage growth may stagnate as businesses become more cautious about increasing labor costs

Policy Implications

The sustained low consumer confidence may prompt responses from policymakers:

- The Reserve Bank of Australia might consider further monetary policy adjustments, such as interest rate cuts, to stimulate spending and borrowing

- The government may propose fiscal measures, such as tax cuts or increased public spending, to boost economic activity and consumer sentiment

Housing Market

The real estate sector, a significant component of the Australian economy, may also feel the effects:

- Potential homebuyers might delay purchases, leading to a slowdown in the housing market

- This could potentially lead to price corrections in some markets, particularly if combined with other economic pressures

Long-term Economic Structure

If low consumer confidence persists for an extended period, it could lead to more structural changes in the economy:

- Shift towards a higher savings rate, changing the balance between consumption and investment in the economy

- Potential changes in consumer behaviour, such as increased preference for value brands or shared/rental models over ownership

What It Means For You

While consumer confidence in Australia shows a slight improvement compared to the same period last year, it remains significantly below pre-pandemic levels. The ongoing economic challenges, particularly in household finances and major purchasing decisions, continue to impact consumer sentiment across the country.

For businesses, adapting to this cautious consumer environment may involve reassessing pricing strategies, focusing on value propositions, and potentially exploring new markets or business models. For policymakers, balancing measures to stimulate short-term spending with long-term economic stability will be a key challenge.

As we move forward, it will be essential to closely watch how consumer sentiment evolves and its impact on spending patterns, business performance, and overall economic growth. The path to a strong economic reality and renewed consumer optimism is likely to be gradual.