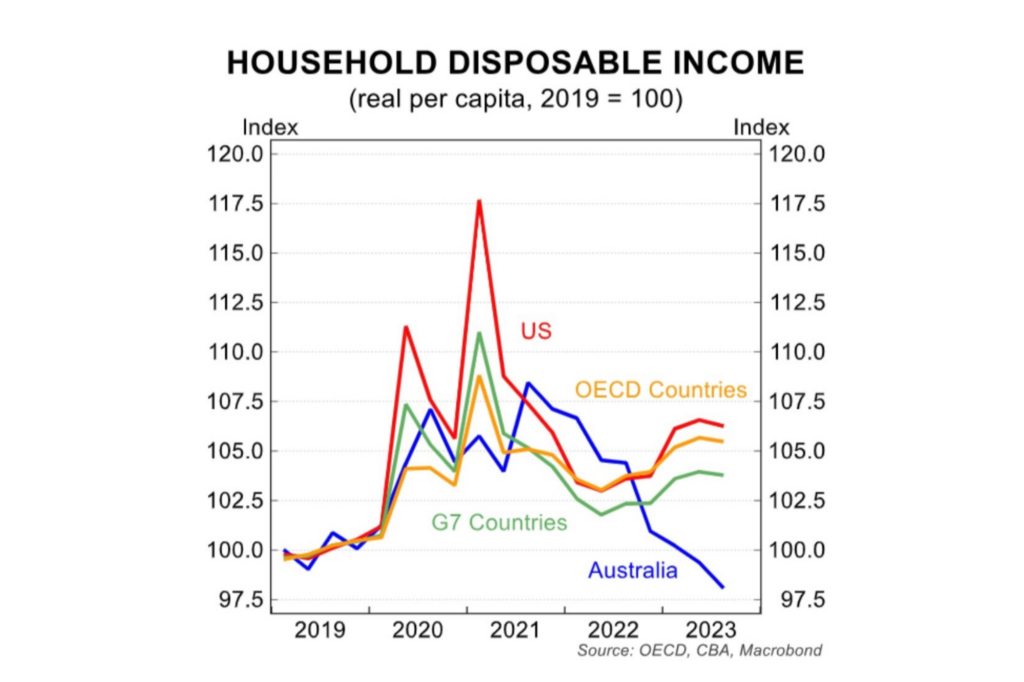

While the Prime Minister and the Treasurer continue to tell us what a great job they’re doing, this chart puts into stark contrast the reality that is facing our economy and how poorly the average consumer is faring compared to other developed economies.

Australia has a woeful lack of diversity in our economy, an economy that could be summed up by explaining our chief offering is we dig rocks out of the ground and send them somewhere else to be refined and we import a very high high proportion of our goods and needs.

We don’t have the manufacturing muscle or innovation that protects our economy and consumer spending of the most important age groups (the group that also is most likely to have a mortgage) is worse than in 1990 when interest rates topped 17%.

The truth is that consumer spending and having a diverse economy matters.

Access to credit also matters to business and if one or both of these fail many people are going to have bigger problems than tightening our belts to make the monthly mortgage repayment. The disingenuous vote buying by current state and federal governments, bottomless money pit of fraud that is the NDIS, the ever expanding government employee headcount that’s going on at both a state and federal level are all inflationary policy decisions by our ‘leaders’ and does the opposite of improving productivity.

The current governments either do not understand basic economics or is hell bent on moving further towards their agenda, even if it comes at the destruction of living standards and the middle class (and I do believe they understand basic economics).

Household Disposable Income and Consumer Spending Matters

The chart at the top of the page starkly illustrates Australia’s declining household disposable income compared to other developed economies. This metric is crucial as it directly impacts consumer spending, which drives about 60% of Australia’s GDP.

For business owners, this trend flags the challenge in maintaining sales and margins in an increasingly difficult economy.

Economic Diversification Insures Against Over Reliance On A Single Sector

Australia’s heavy over reliance on resource extraction and exports leaves the economy vulnerable to global commodity price fluctuations and geopolitical events (like China closing the South China Sea or being sanctioned for invading Taiwan).

With the number of potential flash points around the world spiking, diversification would benefit our wellbeing significantly. And, let’s be honest, if China’s economy falters we are in deep trouble.

A Manufacturing Sector Is A Must Have

A robust manufacturing sector provides economic stability and high-quality jobs. Australia’s declining manufacturing base contributes to economic fragility. Revitalising manufacturing could reduce reliance on imports, create more stable employment that’s less susceptible to shocks and make the economy more resilient overall.

But that’s not all. A robust manufacturing sector is particularly valuable in a world of increasing geopolitical tension for several reasons:

- Economic security and self-reliance:

- Reduces dependency on foreign suppliers for critical goods

- Ensures access to essential products during global disruptions

- Allows for rapid pivoting of production during crises (e.g. manufacturing is something we should have if we’re ever involved in a war)

- Supply chain resilience:

- Shortens supply chains

- Enables better quality control and faster response to market changes

- Mitigates risks associated with global shipping disruptions, like the Houthis in the Red Sea.

- Strategic autonomy:

- Maintains capacity to produce vital defense and technology components

- Reduces potential for economic coercion by other nations

- Preserves technical knowledge and skills within the country

- Economic diversification:

- Balances the economy, reducing overreliance on specific sectors (like resources)

- Creates a wider range of job opportunities across skill levels

- Enhances export potential with value-added products

- Innovation ecosystem:

- Fosters R&D in advanced manufacturing techniques

- Encourages collaboration between industry and universities

- Drives technological advancements that can benefit multiple sectors

- National security:

- Ensures production capability for critical defense equipment

- Reduces reliance on potentially hostile nations for essential goods

- Maintains industrial capacity that can be leveraged in times of conflict

- Economic multiplier effect:

- Manufacturing tends to have a higher economic multiplier than many service industries

- Supports a network of related businesses and services

- Contributes to a more robust middle class, supporting overall economic stability

While Australia may not compete with low-cost manufacturing hubs in all areas, focusing on high-value, advanced manufacturing aligns well with the country’s skilled workforce and innovative potential.

Access To Credit Makes Or Breaks An Economy

Access to credit is vital for business growth and consumer spending. Tight credit conditions can stifle economic expansion. For business owners and mortgage holders, this means:

- Potentially higher borrowing costs

- More stringent lending criteria

- Reduced ability to invest in business growth or manage personal finances

Government Spending and Inflation

While some government programs are necessary, excessive spending can lead to inflationary pressures. For business owners and mortgage holders, inflation erodes purchasing power and obviously leads to higher interest rates and a higher cost of credit.

Much Needed Policy Recommendations

- Targeted incentives for manufacturing and innovation

- Review and reform of government spending programs (starting with the NDIS)

- Investment in productivity-enhancing infrastructure and education

- Policies to encourage economic diversification

If You Need Access To Credit Don’t Leave It Until Your Desperate

During COVID we saw an increase in the number of home owners seeking to draw on the equity in their homes to create a potential safety net against being made unemployed. Creating a backup plan ahead of time (and utilising offset accounts to mitigate the cost of this) will give you more options than if you come to seek credit support when your situation becomes desperate.

Similarly, business owners who seek to establish lines of credit when they are in a strong position will have access to more options and a cheaper cost of funding than if they wait until they’re struggling to stay solvent.

If you imagine yourself needing credit in the future get in touch.