Key Takeaways

- The report assesses housing affordability in 94 major markets across eight nations.

- Housing affordability is rated using the median multiple (median house price divided by median household income).

- The report highlights the deterioration of housing affordability due to restrictive land use policies and urban containment strategies.

- It emphasises the economic and social impact of high housing prices, particularly on middle-income households.

Australian Property Markets

- Australian markets have a median multiple of 9.7, indicating severe unaffordability.

- Sydney is the second least affordable market internationally with a median multiple of 13.8.

- Melbourne (9.8), Adelaide (9.7), Brisbane (8.1), and Perth (6.8) are also severely unaffordable.

- Housing affordability in Australia has deteriorated significantly since 2019.

Ranking Table of Least Affordable Cities

- Hong Kong – 16.7

- Sydney – 13.8

- Vancouver – 12.3

- San Jose, CA – 11.9

- Los Angeles, CA – 10.9

- Honolulu, HI – 10.5

- Melbourne – 9.8

- San Francisco, CA – 9.7

- Adelaide – 9.7

- San Diego, CA – 9.5

- Toronto – 9.3

Affordable housing is directly correlated with economic stability and social well-being. It enables individuals and families to allocate resources to essential areas such as healthcare, education, and savings (and actually having families).

Affordable housing also fosters community stability, reduces poverty, and promotes upward mobility.

Without affordable housing, the potential exists for many to be forced into substandard living conditions or homelessness, exacerbating social inequalities and economic challenges.

Affordable housing is the key to maintaining a healthy middle class.

Overview of Housing Affordability

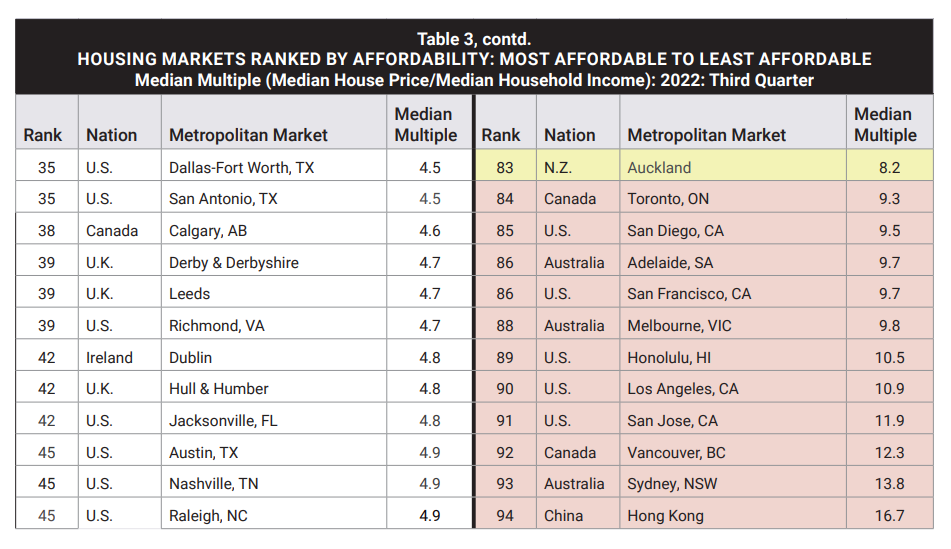

The 2024 edition of the Demographia International Housing Affordability report assesses housing affordability in 94 major markets across eight nations. The report uses the median multiple—median house price divided by median household income—as a primary metric for assessing affordability. Housing markets are categorised from “affordable” to “impossibly unaffordable” based on their median multiple.

High-Income Nations Have A Housing Affordability Crisis

The report highlights a critical issue: housing affordability has deteriorated significantly across many high-income nations. This trend is largely driven by restrictive land use policies and urban containment strategies, which limit the availability of developable land, drive up land prices, and, consequently, housing costs. These policies, though well-intentioned to control urban sprawl, have unintentionally exacerbated the housing affordability crisis.

Australian Property Markets

Australia exemplifies the housing affordability crisis. All major markets in Australia are severely unaffordable, with a national median multiple of 9.7.

Sydney, in particular, stands out with an impossibly unaffordable median multiple of 13.8, making it the second least affordable market internationally.

Other major cities such as Melbourne (9.8), Adelaide (9.7), Brisbane (8.1), and Perth (6.8) also fall into the severely unaffordable category.

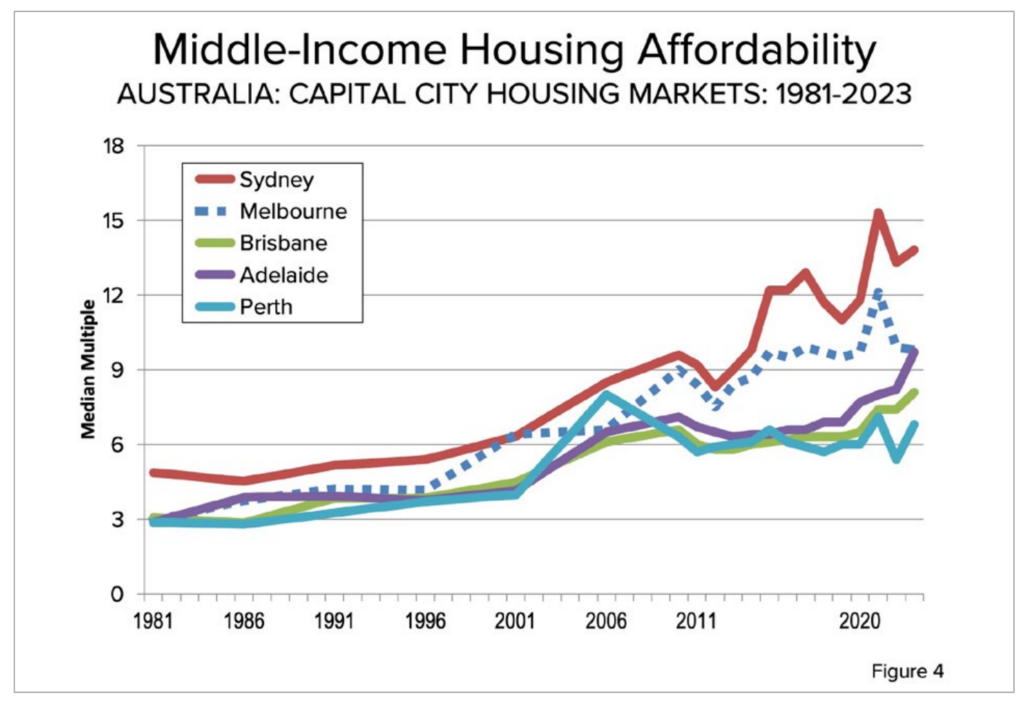

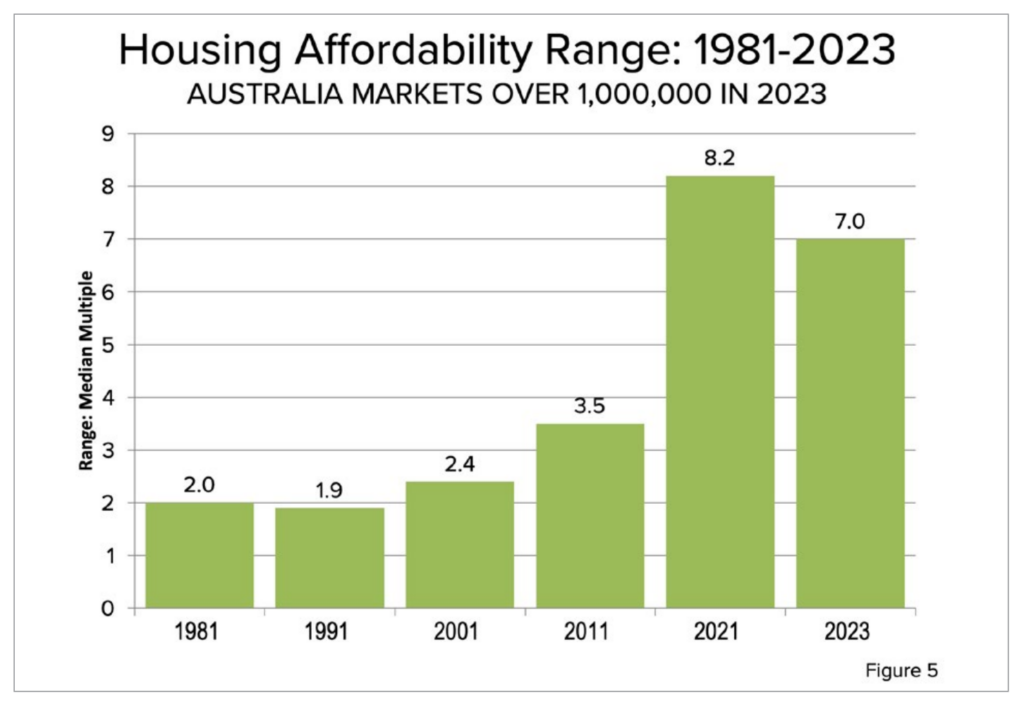

Decline in Housing Affordability Over Time

The decline in housing affordability in Australia has been stark over recent decades. In the early 2000s, major Australian markets were already entering the severely unaffordable range. By 2019, the median multiple had reached 6.9, and by 2023, it soared to 9.7. This increase signifies a substantial escalation in housing costs relative to incomes, making homeownership increasingly unattainable for middle-income households.

Factors Contributing to the Crisis

Several factors contribute to the worsening housing affordability in Australia and other high-income nations:

- Urban Containment Policies: These policies, including greenbelts and urban growth boundaries, restrict the supply of developable land, driving up land prices.

- Speculative Investment: High returns on property investments have attracted speculative activities, further inflating housing prices.

- Inadequate Supply: Despite increasing demand, the supply of new housing has not kept pace, particularly in desirable urban areas.

The Impact on Middle-Income Households

The housing affordability crisis disproportionately affects middle-income households. As housing costs outpace income growth, more households struggle to afford homeownership. This trend has severe implications for social mobility and economic stability. High housing costs limit the ability to save, invest in education, and plan for retirement, leading to broader economic consequences.

International Comparisons

The report provides a comparative analysis of housing affordability across different nations. Hong Kong remains the least affordable market with a median multiple of 16.7, followed by Sydney at 13.8 and Vancouver at 12.3. Other severely unaffordable markets include San Jose (11.9), Los Angeles (10.9), and Honolulu (10.5).

Proposed Solutions and Reforms

To address the housing affordability crisis, several policy reforms are proposed:

- Land Use Reforms: Increasing the supply of developable land by relaxing urban containment policies.

- Incentivising Development: Encouraging the construction of affordable housing through incentives for developers.

- Financial Mechanisms: Implementing innovative financing solutions to support infrastructure development and housing construction.

New Zealand’s Model

New Zealand offers a potential model for addressing housing affordability. The newly elected coalition government plans to implement policies aimed at reducing land costs by increasing the supply of developable land. These policies include zoning for 30 years of housing growth and utilising special-purpose vehicles for financing infrastructure.

Need to address the affordability of your mortgage?

Talk to an expert and get the best deal for your home loan.