Key Takeaways

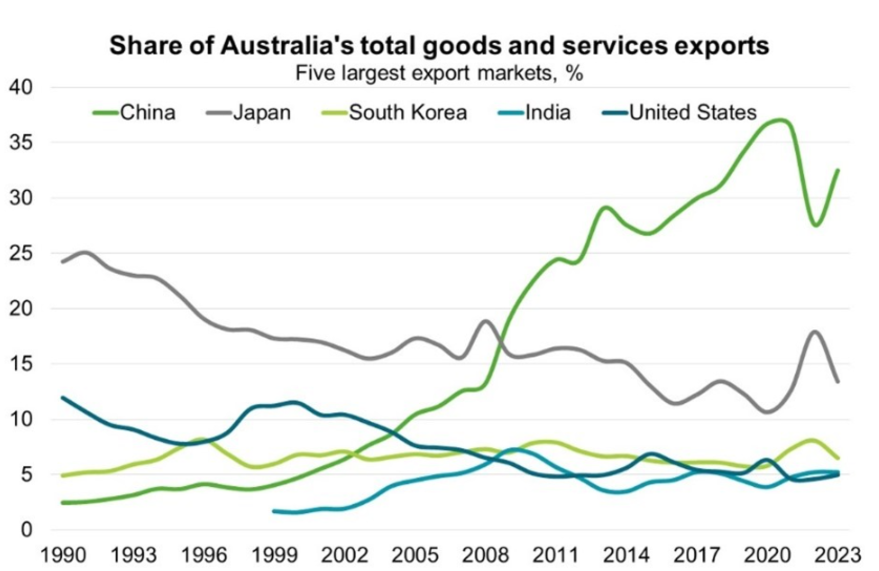

- China buys a massive 32.5% of Australia’s exports, making it Australia’s largest trading partner by far. This relationship generates billions in revenue, especially through iron ore exports, the cornerstone of the Australian economy.

- Issues over Taiwan and South China Sea claims, along with U.S.-China tensions, put the economic partnership at risk. Military conflict or economic sanctions could disrupt trade instantly, severely impacting Australia.

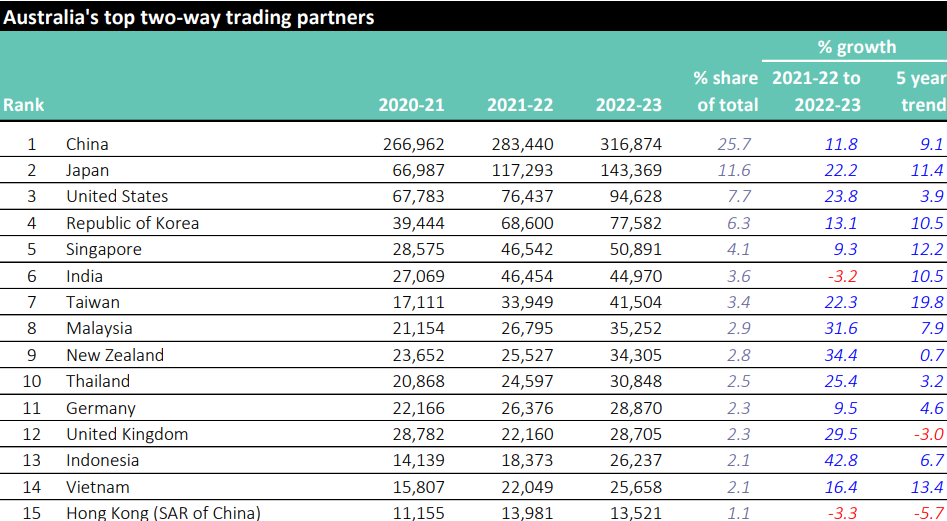

- While Australia is exploring partnerships with India, Japan, and the U.S., none of these markets can match China’s demand. For instance, India accounts for only 3.6% of Australia’s trade, while China represents over one-quarter of all trade.

- If China were to enter a recession, Australia would face job losses, reduced tax revenue, and a weaker currency, all of which would ripple through the economy, raising costs for consumers and businesses alike.

An Economic Partnership Built on Fragility

The Australia-China trade relationship represents both a significant advantage and a vulnerability.

Yes, the trade partnership has undoubtedly brought substantial wealth to Australia. The steady demand for iron ore, which fuels China’s construction boom, along with coal, beef, and barley exports, has strengthened Australian industries. However, this reliance creates a risky situation, often criticised as a major weakness that has been ignored for far too long.

Australia has effectively become what some analysts describe as a “one-customer economy.” With 32.5% of its exports directed toward a single nation, the country operates on a fragile tightrope. This heavy reliance on one trade partner, though lucrative in the short term, is increasingly viewed as complacency masquerading as pragmatism.

What Does China and Australia Trade?

China is Australia’s largest two-way trading partner, accounting for 26% of all goods and services trade in 2023—a staggering share that speaks volumes about the depth of this economic relationship. In 2023 alone, two-way trade with China surged by 9.3%, reaching $327.2 billion. While these numbers might appear impressive, they underscore a dangerous over-reliance that Australia seems unwilling—or unable—to shake.

Australia’s exports to China highlight the backbone of this relationship:

- Iron Ore. The lifeblood of Australia’s mining sector, contributing billions to the economy.

- Coal. Essential to China’s energy needs and a staple of Australian exports.

- Agricultural Products. Including beef, barley, and dairy products.

- Education and Tourism. Chinese students and tourists generate substantial revenue for Australia’s universities and local economies.

On the other hand, Australia imports a range of goods from China, including electronics, semiconductors, and essential medical supplies. These imports fill critical gaps in Australia’s supply chain, making the economic relationship mutually beneficial. But therein lies the problem.

These figures paint a picture not of partnership, but of dependence. While China’s demand has fueled Australia’s growth, the question here is: what happens if this demand falters or disappears entirely? The current state of trade, though beneficial, ties Australia’s economic fortunes far too closely to the whims of Beijing—a tricky gamble with stakes that are only getting higher.

Rising Risks in the China-Australia Economy

Why Is There a Risk to Trade?

Tensions in the Indo-Pacific region, particularly over Taiwan, have created significant uncertainty in China’s trade relationships. Australia’s commitment to “freedom of navigation” in the South China Sea and alliances with the United States have intensified its strategic opposition to China’s territorial claims. If China’s actions lead to military conflicts or blockades, it could result in a rapid economic decoupling, with immediate consequences for Australian industries that depend on Chinese demand.

The economic impact could mirror the effects of Japan’s 1990s recession on Australia, when Japan, then Australia’s largest trading partner, experienced an economic downturn that reverberated through the Australian economy, causing job losses and a rise in interest rates.

What Happens to Australia if China Goes Into Recession?

A recession in China would be disastrous for Australia’s economy, potentially triggering:

Job Losses. Industries such as mining and agriculture in Australia are heavily reliant on Chinese demand. In 2023, China accounted for 32% of Australia’s total exports, with iron ore comprising almost 60% of Australian goods exports to China over the year to May 2024. A decline in Chinese demand could result in reduced production, leading to job losses in regions dependent on these sectors.

- Revenue Drops. The Australian government derives substantial revenue from industries that export to China. In the 2023–24 fiscal year, company tax receipts totaled $126.7 billion, with a significant portion contributed by the mining sector, which is heavily reliant on Chinese demand. A decrease in exports to China would likely reduce these revenues, potentially affecting funding for public services.

- Currency Devaluation. The Australian dollar is sensitive to commodity prices and global demand, particularly from China. In July 2024, concerns over China’s economic slowdown led to a depreciation of the Australian dollar from a six-month high of 68 US cents to under 66 US cents. A long recession in China could further weaken the currency, increasing the cost of imports and contributing to domestic inflation.

Could Australia’s Economy Survive Without China?

Australia has explored alternatives to reduce its reliance on China, strengthening trade with nations like India, Japan, and the U.S. But these markets, while promising, don’t match China’s demand, particularly for high-value exports like iron ore. Here’s a closer look at potential alternative markets:

Why Alternatives Fall Short of China’s Demand

- India. An emerging market with a growing economy; however, it currently lacks the capacity to absorb Australian exports at the scale China does. In 2022-23, India’s share of Australia’s total two-way trade was 3.6%, valued at 45.0 billion dollars. While there is potential for growth, the existing trade volume is considerably smaller than that with China.

- Japan. A strong partner but has a smaller market for Australian exports compared to China. Japan has been a longstanding and reliable trading partner for Australia. In 2022-23, Japan accounted for 11.6% of Australia’s total two-way trade, valued at 143.4 billion dollars. Despite this strong relationship, Japan’s market size and demand for Australian resources are less than China’s, making it challenging to fully offset any reduction in trade with China.

- United States. A major global economy with a focus on technology and services. In 2022-23, the U.S. accounted for 7.7% of Australia’s total two-way trade, valued at 94.6 billion dollars. The U.S. demand for bulk commodities like iron ore and coal is limited compared to China, reflecting its different industrial needs and resource availability.

While these markets could help diversify Australia’s economic partners, none of them offer a full replacement for China’s demand. Transitioning would take time, government investment, and new trade policies focused on building resilience in Australian industries.

Can Australia Afford to Stand Alone?

Given the scale of Australia’s reliance on China, a sudden break in trade would likely trigger a severe economic shock. This situation isn’t just theoretical—history has shown the risks. Australia’s recession in the early 1990s, following Japan’s asset bubble collapse, led to soaring interest rates and unemployment. If China’s economy faced a similar crisis, or if tensions led to a breakdown in trade, Australia could experience an economic downturn even more severe than in the 1990s.

While diversifying trade and investing in self-reliance are positive steps, the reality is that the Australia-China trade relationship is essential. The question isn’t just whether Australia can survive without China, but at what cost to jobs, industry, and long-term prosperity.

Conclusion

Australia’s economic relationship with China is not just a trade partnership—it’s a crucial pillar of the nation’s financial stability. With China buying over 30% of Australia’s exports, particularly iron ore, this partnership sustains thousands of jobs, fills government coffers with tax revenue, and keeps sectors like mining and agriculture thriving. But if this lifeline were to suddenly break, the fallout would be severe and immediate.

The potential impact of losing China as a trade partner would reach far beyond industry figures. Job losses would ripple through mining towns and farming communities, government revenue would dip, threatening funding for essential services, and the Australian dollar would likely weaken, driving up prices on imports and everyday goods.

A trade collapse with China could mean higher costs for households, increased inflation, and a level of economic uncertainty that Australia hasn’t seen since the early 1990s recession.

While Australia is exploring trade options with India, Japan, and the U.S., these markets simply cannot replace China’s scale and demand for Australian exports, especially in the resource sector. Building resilience in alternative markets is promising but would take years of investment and policy shifts to even partially offset China’s economic influence.

In reality, Australia’s economic prosperity and stability are deeply tied to China. A sudden break in trade would bring challenges that would require a major, long-term restructuring of Australia’s economic strategy and trade policies. The question is not just whether Australia could survive without China, but at what cost to its economic future and global standing.

Can Australia afford to stand independently, or is the partnership with China simply too vital to let go?

https://www.dfat.gov.au/geo/china/china-country-brief

https://www.cfr.org/backgrounder/china-taiwan-relations-tension-us-policy-biden

https://melbourneasiareview.edu.au/china-and-australia-economic-decoupling/

https://www.investopedia.com/terms/l/lost-decade.asp

https://budget.gov.au/content/bp1/download/bp1_2024-25.pdf

https://www.abc.net.au/news/2024-07-25/australian-dollar-slide/104140494

https://www.rba.gov.au/publications/confs/2003/posen-disc.html