Key Takeaways

- Mexico surpasses China in U.S. trade for the first time in 20 years, reshaping global supply chains.

- China vs. Mexico trade war intensifies as U.S. tariffs push businesses toward Mexico trade advantages.

- Nearshoring fuels U.S. and Mexico trade, with Tesla, Foxconn, and General Motors investing billions in Mexico.

- U.S. trade with Mexico faces uncertainty as Trump’s new tariffs on Mexico imports threaten growth.

- Mexico’s future as a manufacturing hub depends on infrastructure, political stability, and keeping costs low.

- China U.S. trade war continues, affecting Mexico imports to U.S. and global economic realignments.

- Australia must adapt, as shifting supply chains impact demand for its resources and exports.

For the first time in two decades, the U.S. buys more from Mexico than China. This isn’t just a trade shift—it’s a major economic and geopolitical shake-up.

China vs. Mexico is now the defining trade war of the 21st century, and Mexico is winning. But can it keep its lead?

The Fall of China’s Trade Dominance

For years, China was the undisputed factory of the world. The U.S. relied on cheap Chinese goods, and businesses enjoyed the cost savings.

But today, U.S. trade with Mexico has surpassed China, marking a fundamental shift in global supply chains.

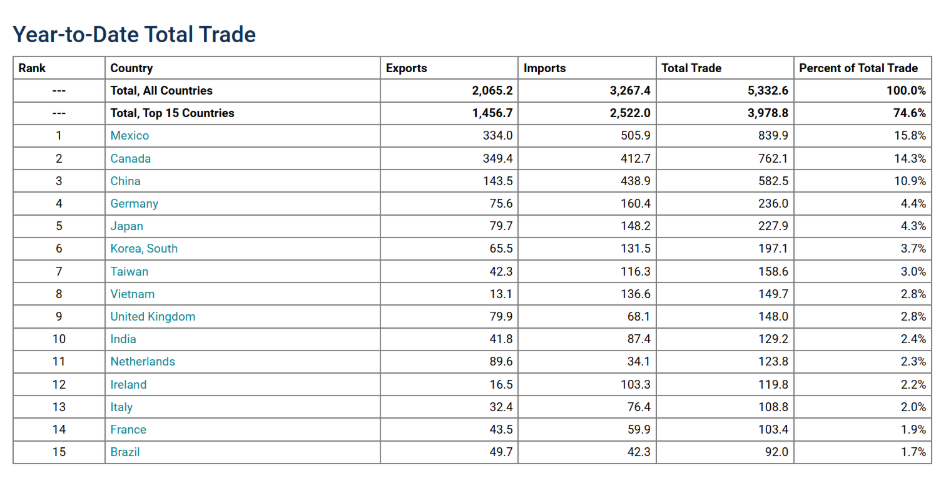

The numbers speak for themselves:

- Mexico’s share of U.S. imports: 15.8%

- China’s share of U.S. imports: 13.5% (down from 21.6% in 2017)

This isn’t an accident. It’s the result of deliberate shifts in corporate strategy, rising costs in China, and escalating U.S.-China trade tensions.

The U.S. trade war with China changed everything. Tariffs on Chinese goods peaked at 15.4% in 2019 and have stayed above 10% since. This forced businesses to rethink their supply chains, looking for cheaper, tariff-free alternatives.

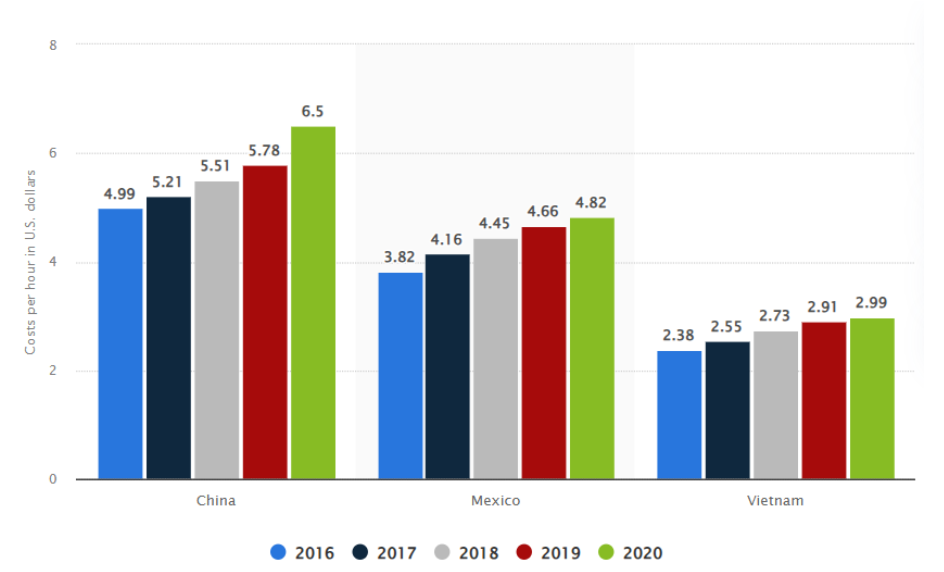

Then, there’s the cost of labour. China’s average manufacturing wage is now $6.50 per hour, compared to $4.82 per hour in Mexico. For corporations looking to cut costs, Mexico is an increasingly attractive option.

The Nearshoring Boom: Why U.S. Companies Are Moving to Mexico

Mexico’s rise isn’t just about cheaper labour—it’s nearshoring. Instead of weeks-long shipments from China, a truck from Mexico to the US arrives in one to two days.

Nearshoring means moving production closer to the end consumer. Instead of shipping goods across the Pacific, companies are setting up factories in Mexico, just hours away from U.S. markets.

This speed, along with trade benefits under the United States-Mexico-Canada Agreement (USMCA), has made Mexico a global manufacturing powerhouse.

Big-name companies are leading the charge:

- Tesla is building a massive gigafactory in Mexico.

- Foxconn (Apple’s main supplier) is shifting production from China to Mexico.

- General Motors and BMW are ramping up Mexican operations to avoid tariffs.

In 2023 alone, foreign direct investment in Mexico’s industrial zones surged by 48%. Real estate demand for factories in northern Mexico is at record highs, with some regions seeing vacancy rates drop below 2%.

For U.S. businesses, it’s a no-brainer. Why deal with tariffs, long shipping delays, and unpredictable Chinese policies when Mexico offers faster, cheaper, and more stable production?

Trump’s Tariffs: Will They Crush Mexico’s Growth?

Trump’s return to office came with a fresh round of tariffs.

In his first month back in office, Trump slapped a 25% tariff on all Mexican imports—citing illegal immigration, drug trafficking, and trade imbalances.

Canada faced similar tariffs. Meanwhile, Chinese imports got hit with a 10% tariff.

The backlash was immediate.

- Mexico and Canada negotiated a one-month delay by agreeing to increase border security.

- China retaliated, imposing a 15% tariff on U.S. coal and liquefied natural gas and a 10% tariff on crude oil and automobiles.

- Global stock markets reacted with volatility and uncertainty.

But here’s the key difference: Mexico isn’t China.

Unlike China, Mexico is deeply tied to the U.S. economy. Nearly 40% of the value of Mexico’s exports to the U.S. come from American-made components. That level of economic interdependence means that tariffs on Mexico hurt American businesses just as much as Mexican manufacturers.

Can Mexico Hold Onto Its Lead in U.S. Trade?

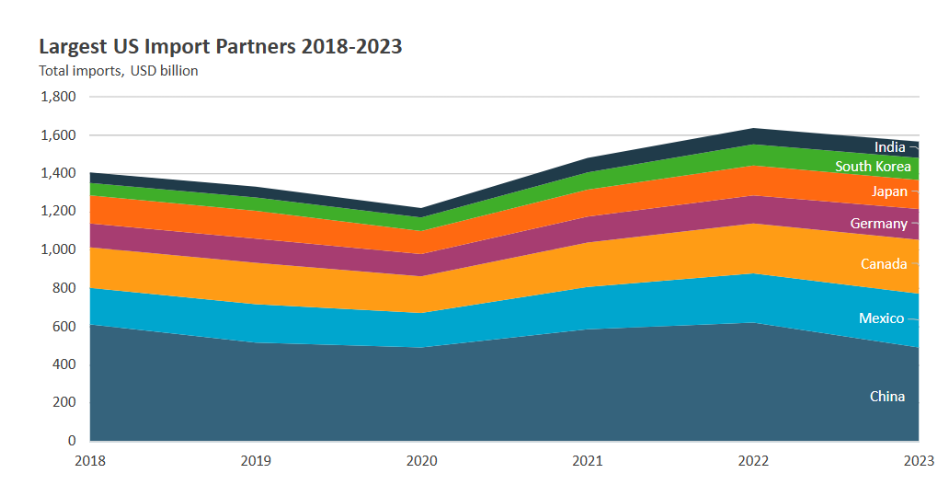

Between 2018 and 2023, total import value from Mexico, Vietnam, and India to the U.S. surged by up to 80%, showing a clear trade shift.

Mexico still holds a key edge—proximity to the U.S. Nearshoring makes production faster and cheaper than relying on Asian supply chains.

But if tariffs rise or infrastructure struggles continue, Vietnam and India could take a larger share of U.S. trade. The competition is no longer just Mexico vs. China—it’s a race for supply chain dominance.

How This Trade War Affects Australia

The U.S.-Mexico shift and the China vs. Mexico trade war have big implications for Australia.

- Australia relies on China for exports, especially iron ore, coal, and agriculture. As U.S. demand moves away from China, Australia may need new markets.

- With Mexico surpassing China in US trade, Australia must reassess its export strategy. If manufacturing moves to Mexico, Australian raw materials could either benefit or see declining demand.

- Australian firms producing in China might rethink their locations. Investing in Mexico could become an alternative.

- Strengthening ties with Mexico, the U.S., and ASEAN nations could reduce economic risks from China’s market volatility.

Mexico’s rise also boosts Australia’s role in the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) trade deal, potentially opening new North American trade opportunities.

While Australia isn’t directly in the crossfire, global trade realignment will reshape its future. Navigating this shift smartly could unlock new trade doors beyond China.

Mexico Trade: A Lasting Shift or Temporary Advantage?

So, is Mexico the new China, or just a temporary substitute?

Right now, Mexico has the momentum. Its proximity, cost advantages, and trade agreements make it the most attractive option for U.S. businesses. But global trade is unpredictable. Policies shift. Economic conditions change.

If Mexico wants to cement its role as a global manufacturing hub, it must:

- Leverage its trade agreements—strengthening ties beyond North America to remain resilient.

- Adapt to shifting U.S. policies—diversifying trade partners to avoid over-reliance on any single market.

- Stay competitive—ensuring cost advantages remain as other nations, like Vietnam and India, maximize their manufacturing sectors.

If it plays its cards right, Mexico could be more than just an alternative to China—it could become a dominant player in its own right.

References:

https://www.census.gov/foreign-trade/statistics/highlights/topyr.html

https://www.ie.edu/insights/articles/the-united-states-buys-more-from-mexico-than-from-chinaat-last/

https://www.state.gov/u-s-relations-with-mexico/

https://www.statista.com/statistics/744071/manufacturing-labor-costs-per-hour-china-vietnam-mexico/

https://www.euromonitor.com/article/exploring-us-trade-evolution-in-five-charts

https://www.dallasfed.org/research/swe/2023/swe2303

https://www.dfat.gov.au/sites/default/files/mexico-country-brief.pdf