Key Takeaways

- No-doc equipment finance is a type of loan that allows you to access the equipment and machinery you need in as fast as 24 hours without providing full documentation.

- Unlike traditional loans, you don't need to provide tax returns and financial statements. Instead, the lender will only need a read-only view of your bank statements.

- Your business must have an ABN and a GST registration and a credit score of at least 550 without previous payment dishonours.

- Loan amounts may vary, but no-doc equipment finance amounts range from around $20,000 to $500,000.

- Benefits of this type of financing include getting access to vital equipment while preserving cash flow. Approvals are also quick, and you don't need to go through the hassle of preparing full documentation.

- Before committing to a loan, research different lenders and compare interest rates, terms, fees, and the equipment types they finance.

- Choose a lender that has experience in no-doc finance. Ideally, the right lender should provide customised solutions that can be approved within the time you need.

Having access to the right equipment can be the key to your business’s success. But what if traditional financing options seem out of reach? Enter no-doc equipment finance — a solution tailored for business owners looking for minimal paperwork and quick approvals. This complete guide will walk you through everything you need to know about no-doc equipment finance, including its benefits, how it works, and what you need to get approved.

What Is No Doc Equipment Finance?

No doc equipment finance is a type of loan designed for businesses that want to acquire equipment without providing full documentation. Unlike traditional loans that require tax returns and financials, no-doc equipment finance only requires a read-only view of your bank statements to determine your capacity to repay.

No doc equipment financing is an attractive option for businesses of all sizes, especially startups, businesses with irregular incomes, and those without full financial records.

Types of Equipment Covered by No-Doc Finance

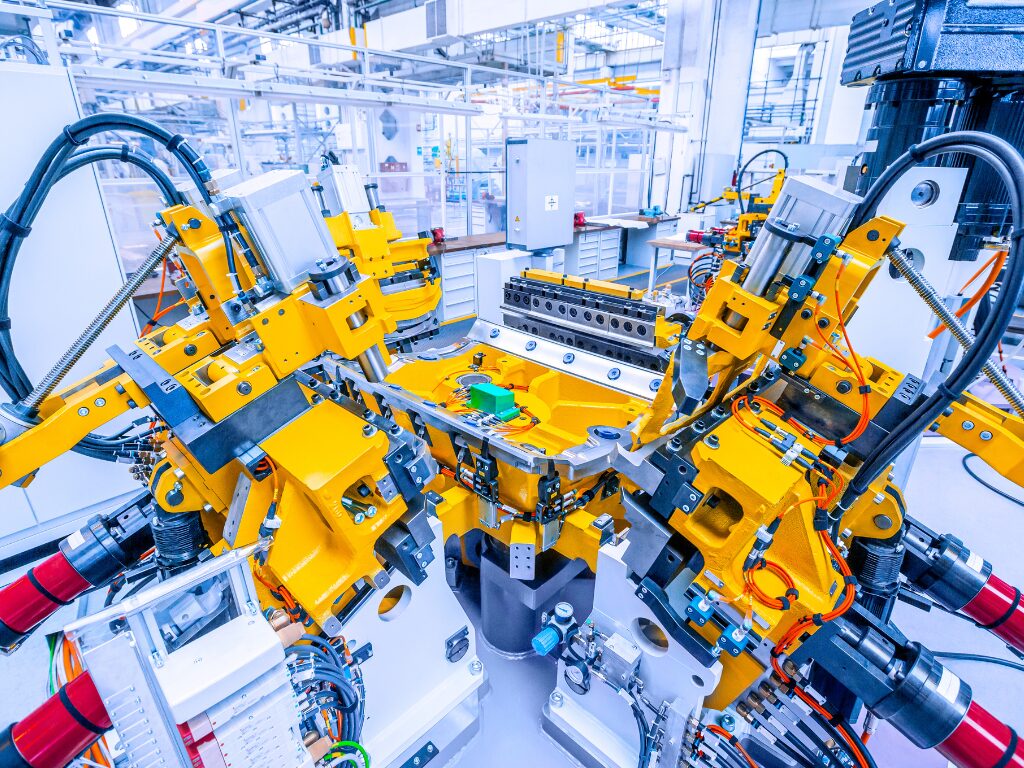

No doc equipment financing can cover a range of assets, both new and used, across industries. Here are common examples:

- Construction Equipment: Excavators, loaders, and cranes

- Retail and Hospitality: POS systems, kitchen appliances, and furniture

- Transportation: Trucks, vans, and logistics machinery

- Medical and Office Equipment: Diagnostic tools and IT infrastructure

How Much Can You Borrow?

The exact amount you can borrow for no-doc equipment finance varies depending on the lender. Loan amounts usually range from $20,000 to $500,000. Loan amounts can be higher for full-doc or low-doc equipment finance.

Benefits of No Doc Equipment Finance in Australia

Choosing no-doc equipment finance comes with several advantages:

Access to Vital Equipment

No-doc finance allows businesses to secure the tools and machinery they need without paying large amounts upfront. The ability to quickly obtain these assets, like machinery and IT infrastructure, can improve your operations and growth potential.

Minimal Paperwork

Traditional financing options often require extensive documentation such as tax returns and financial statements. With no-doc equipment financing, you don’t need to present these. This benefit is particularly useful for businesses that lack comprehensive financial records.

Fast Approval

No-doc equipment finance streamlines the approval process, with many lenders providing decisions within 24 to 48 hours. This speed allows you to quickly acquire essential equipment and maintain operations.

Preserves Cash Flow

Large upfront payments for equipment can strain your business’s cash flow. No doc equipment financing allows you to spread the cost over manageable monthly payments, ensuring you have enough working capital to handle other business expenses.

Eligibility Requirements

This type of financing doesn’t require you to present full documentation. However, most lenders will need to see the following:

- ABN: Your business must have an Australian Business Number and a GST registration to be eligible.

- Credit History: Lenders typically look for a credit score of at least 550 with no record of dishonours.

- Proof of Income: Lenders don’t need financials but will require a read-only view of your bank statements.

How No Doc Equipment Financing Works

The process for no-doc equipment finance is straightforward:

- Identify the Equipment: Determine the type, age and cost of the equipment you need.

- Reach Out to Us: Contact us, and we’ll help you find the best lender fit for your business. We’ll also help you secure the best rates and terms for your loan.

- Submit an Application: Provide basic information about your business and the equipment. You will need to prepare minimal requirements.

- Approval and Funding: Once approved, you can get access to the equipment you need in as fast as 24-48 hours.

What is a Balloon Payment in No Doc Equipment Finance?

In some cases, lenders do allow balloon payments for no-soc equipment finance. A balloon payment is a large, lump-sum payment due at the end of a loan term. This structure allows businesses to pay smaller monthly instalments throughout the loan period, deferring a large portion of the principal to the final payment. However, businesses must plan carefully to ensure they can manage the final payment.

When Should a Business Consider a Balloon Payment?

- Seasonal Cash Flow: Businesses with fluctuating income streams, such as those in agriculture or retail, may benefit from lower payments during lean periods.

- High Equipment Resale Value: If the equipment is likely to retain significant value, businesses can sell it to cover the balloon payment.

- Planned Growth: Companies expecting increased revenue in the future may choose this option to align higher payments with anticipated earnings.

- Short-Term Use: For equipment needed only temporarily, a balloon payment can minimise upfront costs.

Factors to Consider Before Applying for No Doc Business Loans

Before diving into no-doc equipment finance, keep these factors in mind:

Interest Rates

Interest rates can vary depending on the lender and your financial situation. It’s crucial to work with the best lender for your circumstances to get the right interest rate.

Loan Terms

Choose repayment terms that align with your cash flow. Shorter loan terms may result in higher monthly payments but lower overall interest costs. Consider the lifespan of the equipment to ensure the loan doesn’t outlast its utility.

Fees and Charges

Look beyond the interest rate to identify additional costs. Common fees include application fees, origination fees, and penalties for late payments or early repayments. Request a full breakdown of charges to avoid unexpected expenses.

Equipment Type

Some lenders may have restrictions on the type of equipment they finance. Ensure the equipment you’re purchasing is eligible and consider its resale value.

How to Choose the Right Lender

Here are some factors to consider when choosing the right no-doc equipment finance lender:

Experience in No-Doc Finance

Not all lenders specialise in no-doc equipment finance. Prioritise lenders with proven expertise in this field, as they understand minimal documentation lending and can offer tailored advice.

Flexibility in Loan Terms

Choose a lender who can customise loan terms to match your cash flow and repayment capacity. Flexible options, such as seasonal adjustments or balloon payments, can significantly help you manage repayments.

Speed of Approval and Funding

One of the main advantages of no-doc finance is its speed. Ensure the lender you choose can process your application quickly and disburse funds within your required timeframe. Delays in funding can hinder your ability to secure necessary equipment promptly.

Range of Equipment Financed

Some lenders specialise in financing specific types of equipment, such as vehicles, IT infrastructure, or heavy machinery. Confirm that the lender covers the equipment category you need and inquire about any restrictions on the type, age, or condition of the equipment.

Use an Equipment Finance Calculator

Our equipment finance calculator can help you estimate how much you’ll pay in monthly installments. This tool is important so you can determine how much you can realistically borrow without disrupting your cash flow. You can use our calculator here.

Final Thoughts

No-doc finance is a great choice for businesses seeking quick access to equipment and machinery. This financing option doesn’t require full documentation, allowing businesses with limited financial records to access the equipment they need to operate and level up.

Ready to Explore No-doc Equipment Finance?

We specialise in connecting Australian businesses with tailored financial solutions. Reach out today to discuss your no-doc loan options and find the best path for your equipment financing needs.