Key Takeaways

- Debt recycling converts non-deductible home loan debt into tax-deductible investment debt.

- To recycle debt, start by borrowing against the equity of your existing property and using the funds to invest. Then, use the returns from your investments to pay off your initial home loan.

- This strategy is suitable for high-income earners, homeowners with equity, and property investors.

- Potential benefits include faster debt repayment, tax savings, improved cash flow, and wealth creation.

- Potential risks involve market fluctuations, additional loan obligations, and tax implications.

- Debt recycling with investment properties can amplify benefits by generating rental income and building equity.

- To recycle debt successfully, you should have oversight from an accountant or financial planner familiar with debt recycling.

Can your mortgage become a tool to build wealth? Debt recycling does exactly that, transforming your existing debt into investments that can boost your financial future. Whether you’re looking to maximise your home’s equity or expand your investment portfolio, debt recycling could be the key to achieving both. Read on to learn all about debt recycling in Australia, how it works, its benefits and risks, and see if it’s the right choice for you.

What is Debt Recycling?

Debt recycling is a strategy where you transform your existing home loan debt (which is not tax deductible) to investment debt (which is tax deductible). It’s essentially turning bad debt into good debt over time.

The primary idea behind this strategy is to use the equity built in your property to generate income from investments while gradually eliminating your existing debt.

Debt recycling is best for homeowners looking to speed up their mortgage repayments and build wealth at the same time.

How Debt Recycling Works

Debt recycling works by replacing non-tax-deductible debt, such as a traditional home loan, with a new, tax-deductible debt linked to income-generating investments.

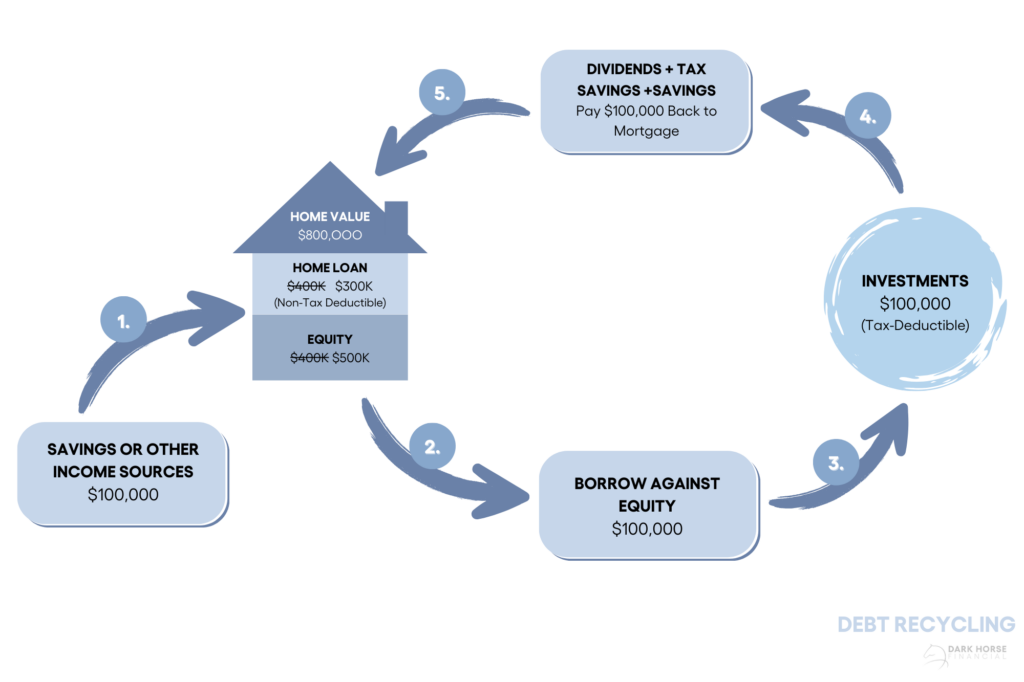

Here’s a simplified breakdown of how debt recycling works:

1. Pay off Your Home Loan with Savings

Start by paying off your home loan with personal cash or savings. As you repay your mortgage, your home equity increases.

2. Draw on the Home Loan’s Equity

In a debt recycling strategy, you use your home equity to secure investments like loans, bonds, or properties. Because the money will be used for investment purposes, the interest on it becomes tax-deductible.

3. Invest the Borrowed Funds

The borrowed amount is reinvested into income-generating assets like stocks, bonds, or investment property.

4. Use Investment Returns and Tax Savings to Pay Down the Home Loan

Any income generated from these investments, including dividends, rent, or interest, can go towards repaying your original mortgage. Additionally, the interest on the new, investment-based debt becomes tax-deductible.

5. Repeat the Process

As more equity becomes available in your home loan, you can borrow again to reinvest. With each cycle, more personal debt is converted into tax-deductible debt, improving your cash flow over time.

Why Recycle Debt?

If you have the capacity for it, you can just repay your home loan and take a separate loan for investment. But why could debt recycling be a smarter move?

For starters, you can gain the potential dual benefit of reducing your home loan (saving on non-deductible interest) while also borrowing for investments (which gives you tax-deductible interest).

If you keep your home loan as is, you’ll still owe a lot in non-deductible interest, making it harder to manage financially in the long run.

By recycling your repayments from your mortgage into investment debt, you reduce non-deductible debt faster and build wealth through investments at the same time.

Benefits of Debt Recycling

Debt recycling offers numerous financial advantages when applied correctly. Below are some of the key benefits that make it an attractive option for homeowners and property investors:

Faster Mortgage Repayment

Debt recycling allows you to pay down your home loan faster by using investment income and tax savings to repay.

Tax-Deductible Interest

When non-deductible personal debt (such as a home loan) is replaced with tax-deductible investment debt, you can reduce your taxable income. This is particularly beneficial for higher-income earners.

Wealth Creation Through Investments

By investing in assets such as investment properties or shares, debt recycling creates potential for long-term financial growth. With the right investments, you could generate income and capital gains over time.

Improved Cash Flow

As you invest borrowed funds in income-generating assets, such as shares or investment property, the returns (like dividends or rental income) provide additional cash flow. This extra income can then be used to make further mortgage repayments, reducing your primary home loan faster. Over time, the combined tax savings and income from investments help free up more cash for future spending or further investments, making it easier to manage finances and build wealth.

Risks and Considerations in Debt Recycling

While debt recycling offers significant financial benefits, it is not without risks. Before diving in, it’s crucial to consider the potential drawbacks.

Market Risks

Investments such as shares or property come with inherent risks. A market downturn could affect your returns, reducing your ability to service the debt or repay your home loan.

Long Term Strategy

Debt Recycling is a long-term strategy. Before you commit, you must understand that tangible results will materialise in years.

Discipline Required

Debt recycling demands careful financial discipline. It’s important to reinvest wisely, monitor cash flow, and avoid using borrowed funds for personal spending.

Debt Recycling for Investment Properties

One great application of debt recycling in Australia is when you use borrowed funds to purchase investment properties. The rental income helps offset costs, plus the interest on the investment loan is tax-deductible.

Here’s how debt recycling can enhance your investment property strategy:

- Increased Borrowing Capacity:

By leveraging your existing home’s equity, you can secure additional loans for investment properties without selling assets. This opens opportunities to grow a property portfolio.

- Rental Income to Cover Debt:

Rental income from the investment property can help pay down your original mortgage and any investment loans you take.

- Property Value Appreciation:

As property values increase, so does your equity, which can be recycled again to fund further investments or debt repayments.

A Debt Recycling Example

Let’s look at a practical example of how debt recycling works:

Imagine you own a home valued at $800,000, and you have a remaining mortgage of $400,000. You want to reduce your mortgage while also starting to invest in income-generating assets. Over time, you manage to accumulate an additional $100,000 saved in your offset.

Step-by-Step:

- Extra Mortgage Repayments

- Using your savings in your offset, you make an additional $100,000 repayment on your mortgage. This brings your mortgage balance down to $300,000, and your equity in the home rises to $500,000.

- Borrow The Same Amount You Paid

- You reborrow $100,000 against the equity in your mortgage. You use the funds specifically for investing in income-generating assets like shares, a managed fund, or investment property.

- Tax-Deductible Interest on the Investment

- Because this $100,000 is used for investment purposes, the interest on this debt can be tax-deductible.

- The loan amount is the same, but $100,000 is now tax deductible so you can claim the interest on that portion as a tax deduction. This means you pay less tax.

- Because you pay less tax, you have more income. Because you have more income, you can make more repayments on your non-deductible balance of $300,000.

- Repeating the Process

- As you keep paying down your original mortgage and re-borrowing for investments, your non-deductible mortgage debt decreases, while your investment loan (deductible debt) becomes a greater proportion of your debt. Because of this, more of your interest repayments are tax deductible.

After Several Years

After consistently following this strategy for a few years:

- Your non-deductible home loan debt has been significantly reduced.

- You’ve built a growing investment portfolio funded through tax-deductible debt, generating income and potentially appreciating in value over time.

Who Can Benefit from Debt Recycling?

Though debt recycling is a great strategy, it’s not for everyone. It tends to be most effective for homeowners with good financial discipline, an appetite for investment, and a solid understanding of their risk appetite. The following groups may find debt recycling beneficial:

- High-Income Earners: Individuals in higher tax brackets can benefit from the tax-deductible nature of investment loans, potentially reducing their taxable income.

- Homeowners with Equity: If you’ve built significant equity in your home, debt recycling can unlock its potential for wealth creation through investments.

- Investors: Debt recycling works well for different investments, as the lower entry points make it more accessible.

Best Practices for Successful Debt Recycling

Here are some practical tips for a successful debt recycling strategy:

Start with a Solid Financial Foundation

Before starting debt recycling, ensure you have a stable income, manageable expenses, and a clear budget. A healthy cash flow will make it easier to handle both mortgage and investment debt.

Build Up Your Home Equity First

Debt recycling relies on tapping into your home’s equity. Aim to pay down a significant portion of your mortgage before starting so that you have enough equity to work with.

Choose Reliable Income-Generating Investments

Debt recycling works best when you invest in assets with steady returns, like dividend-paying stocks or rental properties. Consistent income can help you cover loan payments and pay down your mortgage faster.

Practice Financial Discipline

The key to successful debt recycling is reinvesting returns, not spending them. Use dividends, rental income, or tax savings to pay down your mortgage and reinvest for future growth.

Keep an Eye on Market Conditions

If investing in shares or property, be mindful of market fluctuations. Diversifying your investments can help spread risk and protect your cash flow.

Review and Adjust Your Strategy Periodically

Your financial situation and goals can change as time goes by. Regularly review your debt recycling plan to ensure it’s still aligned with your objectives and adapt it as necessary.

Stay Committed

Debt recycling is a long-term strategy, so it may take years to see significant results. Patience and consistency will maximise the benefits over time.

Work with a Financial Expert

An accountant or a mortgage broker experienced in debt recycling can help structure your loans, recommend tax-efficient strategies, and guide you through each step. They’ll ensure the plan aligns with your financial goals and risk tolerance.

Final Thoughts

Debt recycling in Australia offers a smart way to manage debt while building wealth through investments. However, it is not without risks. Debt recycling requires careful planning, financial discipline, and market awareness.

If you’re considering debt recycling as a strategy, it’s best to seek advice from financial experts to ensure it aligns with your long-term goals. With the right approach, debt recycling can become a powerful tool for creating wealth and securing your financial future.

Ready to Make Your Debt Work For You?

We’re experts in debt strategies—we’ll help you figure out the best way to maximise the equity in your home through smart investments.

If you’re ready to take on debt recycling, get in touch with us today.