In any business, cash flow is the lifeblood that sustains operations and drives growth. However, even Australia’s most seasoned business owners can encounter cash flow problems. Of course, the same thing can be said for small business owners. In fact, the QuickBooks State of Small Business Cash Flow survey, which includes responses from Australian small business owners, reveals that 61% regularly face cash flow issues. This has led to 32% being unable to pay suppliers, loans or even themselves and their employees. If you want to avoid going the same route, you must identify and get rid of cash flow bottlenecks in your company as early as possible.

Key Takeaways of Cash Flow Problems for Businesses

| Key Points | Description |

|---|---|

|

Identifying Cash Flow Bottlenecks

|

Pinpointing where exactly the cash flow bottlenecks are, allows for timely and effective intervention.

|

|

Common Cash Flow Management Mistakes

|

Good cash management flow begins by avoiding mistakes like making unplanned purchases or neglecting delayed payments.

|

|

Solutions for Improving Cash Flow

|

Cash flow issues can threaten your growing business. Fortunately, you can employ proactive strategies to resolve them.

|

Identifying Cash Flow Bottlenecks

Early detection is key to addressing cash flow issues. So, before we talk about cash flow lending and other possible solutions, let’s briefly examine the common causes of a business’s cash flow crisis.

Delayed Customer Payments

One major cause of cash flow issues is customers delaying payments. Clear signs include outstanding invoices beyond the agreed terms, frequent excuses for late payments and a pattern of slow payments across multiple clients. If you have noticed that a significant portion of your receivables are 30 or 60 days overdue, you’re facing a trend of slow-paying debtors that can hurt your cash flow finance.

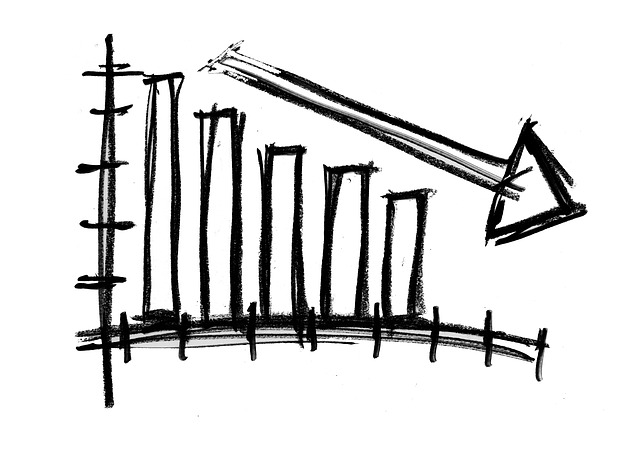

Sales Shortfall

Pricing Missteps and Over-Discounting

Overburdened by Debt

Business debt isn’t always a bad thing. It can help boost your revenues and ignite your growth when you use it strategically and responsibly. Excessive debt, however, is another story. If your business has a high debt-to-income ratio, relies too much on credit for regular expenses and finds it difficult to meet repayment deadlines, you clearly have a cash flow bottleneck at hand.

Common Cash Flow Management Mistakes

Apart from pinpointing exactly where the cash flow bottlenecks are, you have to be aware of common cash flow management mistakes that could hurt your business’s financial health. Here are some missteps to keep in mind:

Lack of Proper Cash Flow Management Strategies

A lack of a clear cash flow management strategy can lead to financial disarray. For instance, if your payment terms with clients are longer than those you have with suppliers, it can create a cash flow gap. So, assess your accounts receivable and payable workflows regularly to identify and address potential bottlenecks.

Neglecting Cash Flow Analysis

Failing to conduct regular cash flow analysis can blindside a business to emerging financial issues. That’s especially true if you run a retail shop or construction firm with seasonal income variations or specific months with higher expenses. You need to spend some time analysing your business’s varying cash flow to plan for cost control measures during low-income periods and recognise the best times for investment.

Impulsive Spending Decisions

You may think upgrading to new sets of equipment or hiring part-time employees for the holiday season is a good idea, but unplanned purchases can disrupt your cash flow management. Major purchases should be part of a strategic plan, considering the timing and impact on cash flow. Similarly, hiring should align with a long-term recruitment strategy, keeping the cash flow implications of new wages in mind.

Inattention to Overdue Payments

Overlooking late payments can significantly damage your cash flow. It’s important to have clear payment terms and use tools like accounting software for automatic reminders. Setting up a systematic follow-up process and a debt recovery plan can help manage overdue accounts more effectively. You can also consider enforcing milestone payment plans. That’s especially beneficial when you’re handling large projects, but one late payment can easily trigger a freeze on another project.

Solutions for Improving Cash Flow

If there’s more cash leaving than entering your company, your business might slow down. However, that doesn’t mean it will immediately come to a halt. Here are the solutions you can employ to bounce back from a cash flow problem.

Develop a Survival Plan

Stop the financial bleeding by breaking down your business plan to focus on immediate survival. Analyse your operations, income and expenses. Then, identify key areas of expenses and profits, such as specific products, services or clients. Your goal is to scale back operational costs while still earning. Running a restaurant? For now, switch to a takeaway model to reduce costs while maintaining some revenue.

Plan a Strategic Expense Reduction

Accelerate Your Receivables

Improve the speed of incoming payments. Send invoices earlier, review billing cycles and encourage early payments. You can also offer small discounts for prompt payments to incentivise your clients to settle their bills earlier than expected.

Evaluate Borrowing Options

When times are tough, consider different loan products to manage your cash flow more effectively. This includes exploring invoice financing, lines of credit or other cash-flow lending solutions for a business. These solutions can help cover short-term cash flow gaps while you continue operating and wait for customer payments. Just make sure to read the fine print and understand how they fit into your survival plan.

Let Dark Horse Financial Help You

Cash flow problems can be a significant hurdle, but with the right solutions, these can be effectively managed and overcome. If you feel overwhelmed, you can rely on us here at darkhorsefinancial.com.au for a financial boost. We specialise in providing tailored solutions to help businesses like yours overcome financial hurdles and thrive. You can count on us to assist you with invoice financing, quick business loans, unsecured overdrafts and other business cash flow loans. Contact us today.