For years, the world has watched Japan through a lens of misplaced pity. Headlines obsess over its slow growth, its declining birth rate, its elderly population. But what if we’re reading the wrong story? What if Japan is not failing—but adapting to a future every developed nation is slowly hurtling toward?

This is the truth behind Japan’s economic stagnation: it isn’t collapse. It’s evolution.

The Peak Before the Fall

After World War II, Japan rose with extraordinary speed. Its cities were in ruins, and its economy devastated. Although hyperinflation hit hard in the late 1940s, by the early 1950s, fiscal reforms brought stability. By 1968, Japan had become the world’s second-largest economy. It wasn’t luck.

Government-led industrial planning, high savings rates, a disciplined workforce, and the keiretsu corporate model laid the foundation for one of the most efficient economies in the world. Japan’s postwar economic boom averaged 10% GDP growth per year. By 1968, it had overtaken West Germany in Gross National Product.

Then came the 1980s: the golden age of Japanese confidence. Tech giants, steel exports, and the domination of global supply chains made Japan look unstoppable.

But the momentum was fragile. And the warning signs were missed.

The Bubble That Was Always Going to Burst

The turning point came in 1985, when Japan signed the Plaza Accord. The yen appreciated rapidly, crushing export competitiveness. Investors turned inward, pouring capital into real estate and equities. The Japan bubble economy took off—until it exploded.

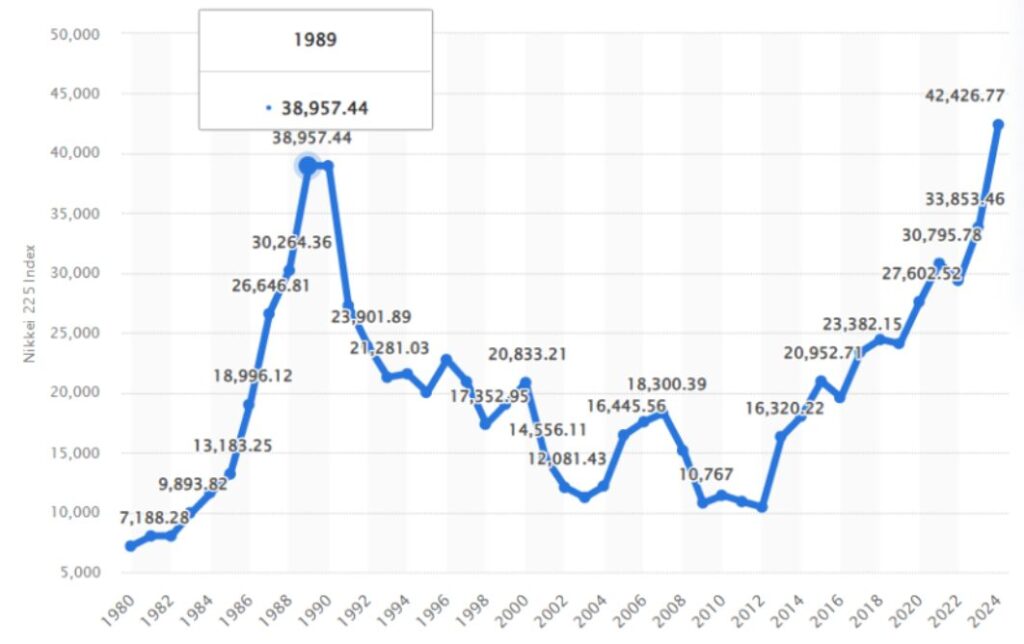

By 1989, Tokyo real estate was worth more than the entire state of California. The Nikkei 225 surged past 38,000. Then in 1990, the crash came. Within a year, the market lost more than half its value. Trillions in paper wealth vanished.

Why did Japan’s economy collapse? Because speculation replaced productivity. Banks lent against inflated assets. Companies borrowed against bubble-era valuations. When the Bank of Japan raised interest rates to cool inflation, it triggered an avalanche.

This wasn’t a correction. It was a system failure.

Japan’s Lost Decade Became a Way of Life

The 1990s were labelled Japan’s lost decade. But the stagnation never really ended.

Real estate prices fell significantly. Banks refused to write off bad loans, creating zombie firms. Government stimulus failed to ignite real growth. Japan’s GDP flatlined. The stock market took 35 years to return to 1989 levels—finally breaking its record in 2024.

Deflation set in. Consumer spending slowed. Wages stagnated. Business confidence never truly returned. But here’s the thing: Japan didn’t collapse.

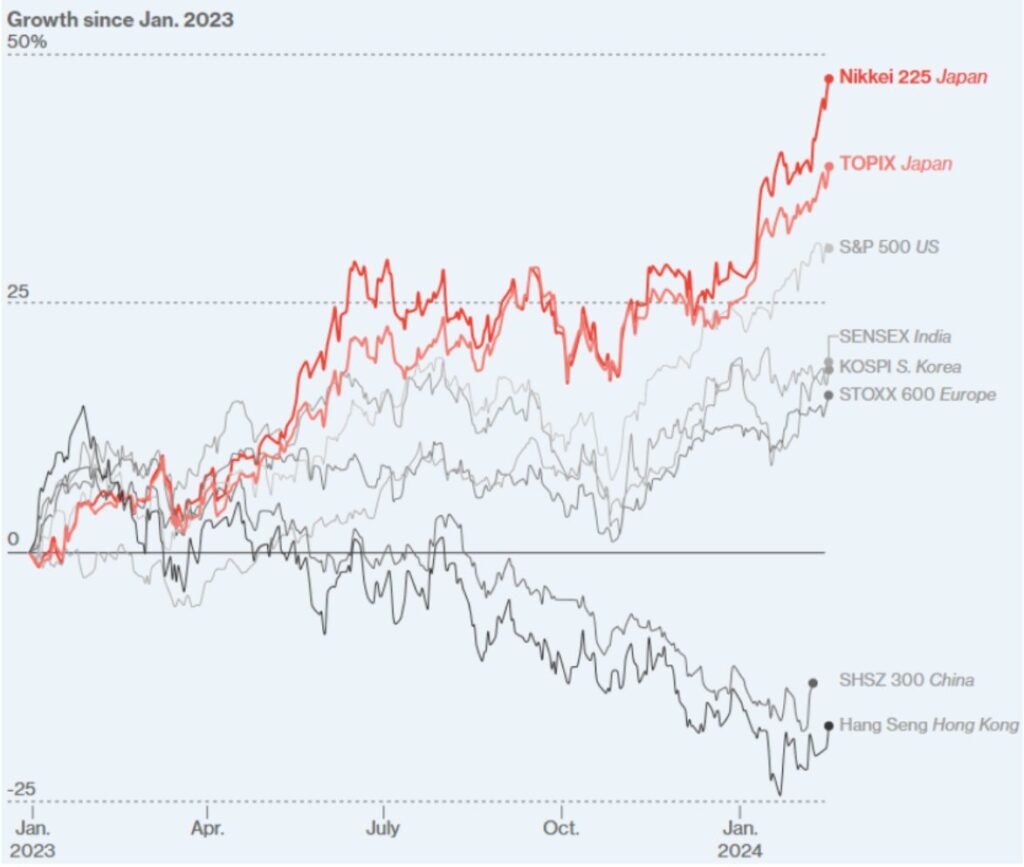

Source: Bloomberg

No Growth. No Crisis. Just Endurance.

Despite three decades of slow growth, Japan remains the world’s fourth-largest economy, worth US$4.2 trillion. Its cities run smoothly. Its trains arrive on time. Its streets are safe. Life expectancy is among the highest on Earth.

Quality of life in Japan hasn’t eroded. If anything, it has stabilised at a level other nations quietly admire. Japan has taken a quieter, more stable path than most economies.

This is Japan’s economic resilience. It didn’t roar back. It didn’t crash either. It endured.

Shown: Highest Nikkei 225 Index Point from 1980 to 2024

Source: Statista

Demographics: The Real Drag on Growth

Japan’s biggest challenge isn’t productivity. It’s people.

The ageing population economy is a defining feature of Japan’s future. Since 2008, its population has been shrinking. In 2023, just 727,277 babies were born. 1.58 million people died. That’s a loss of over 850,000 people in a single year.

Today, the median age is 49.8. By 2070, 40% of Japan will be over 65. This demographic cliff makes GDP growth almost impossible. Fewer workers, more retirees, lower consumption.

Immigration could offset the decline—but Japan remains culturally resistant. It’s one of the few countries unwilling to swap demographic purity for economic expedience.

The Tech Pivot: Automation as Survival

Japan didn’t sit idle. It adapted.

Facing labour shortages, Japan doubled down on robotics, AI, and automation. It now leads the world in factory robotics per capita. From humanoid machines in customer service to AI-powered manufacturing, Japan technology and automation became core to its economic model.

This isn’t Silicon Valley disruption. It’s systemic transformation. Where other countries see job threats, Japan sees continuity.

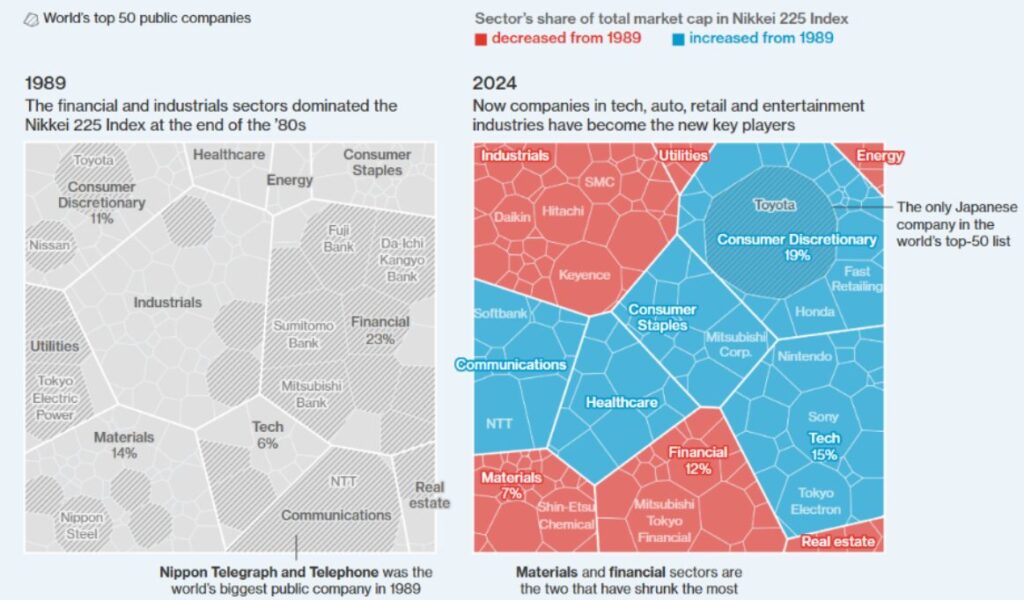

The corporate landscape transformed too. In 1989, financial institutions and real estate companies dominated the Nikkei 225. Today, it’s companies like Toyota, Sony, and Nintendo driving innovation and exports. Speculation was replaced by sustainability.

This shift in Japan’s industrial DNA is clearly visible in how the Nikkei 225 index has evolved over the decades.

Source: Bloomberg

The Financial Tightrope

Japan’s ultra-low interest rates kept the economy stable—but they created a new risk: the yen carry trade.

For decades, global investors borrowed cheap yen and invested elsewhere at higher returns. It kept Japan’s rates low and its currency weak, helping exporters. But now, interest rates are rising. If the Japan yen carry trade unravels, the yen could strengthen fast, punishing exporters and potentially tipping the country into recession.

Japan’s economic stagnation is stable—but fragile. Any jolt could upset the balance.

Is Japan Really Declining?

Japan’s growth has slowed, yes. But decline? That’s a Western projection.

What if the real story is that Japan got there first? First to the demographic crisis. First to zero interest rates. First to widespread automation. First to long-term stagnation without collapse.

Europe is ageing. China is ageing faster. The U.S. is wrestling with declining birth rates and productivity challenges. The future of Japan’s economy may be the future of all rich nations.

What Japan shows us is that post-growth doesn’t mean post-prosperity. It means recalibration. Growth for growth’s sake may no longer be viable. Quality of life in Japan suggests that success can look different.

Redefining Economic Success

It’s time to stop using GDP growth as the only yardstick.

Japan’s economy has problems—but it also has peace, safety, longevity, and function. Its infrastructure is world-class. Its citizens are educated, healthy, and stable. Isn’t that the point of prosperity?

The lesson from Japan isn’t how to avoid stagnation. It’s how to survive it. Maybe even thrive in it.

The Final Word

Japan’s economic stagnation isn’t a warning. It’s a model.

While the rest of the world obsesses over rebounds, recoveries, and expansion, Japan has done something few others dared: it embraced equilibrium.

In a world of ageing populations, climate pressures, and post-industrial uncertainty, maybe that’s not a failure.

Maybe it’s the future.

References:

https://www.rieti.go.jp/en/papers/contribution/okazaki/06.html

https://sites.psu.edu/global/2018/11/06/japans-economic-miracle/

https://aboutjapan.japansociety.org/content.cfm/the_political_economy_of_high-growth-era_japan

https://www.investopedia.com/terms/p/plaza-accord.asp

https://www.voronoiapp.com/debt/Countries-with-Highest-Debt-to-GDP-2024-Rankings-1833

https://www.cnbc.com/2024/02/15/japan-loses-spot-as-worlds-third-largest-economy-to-germany.html