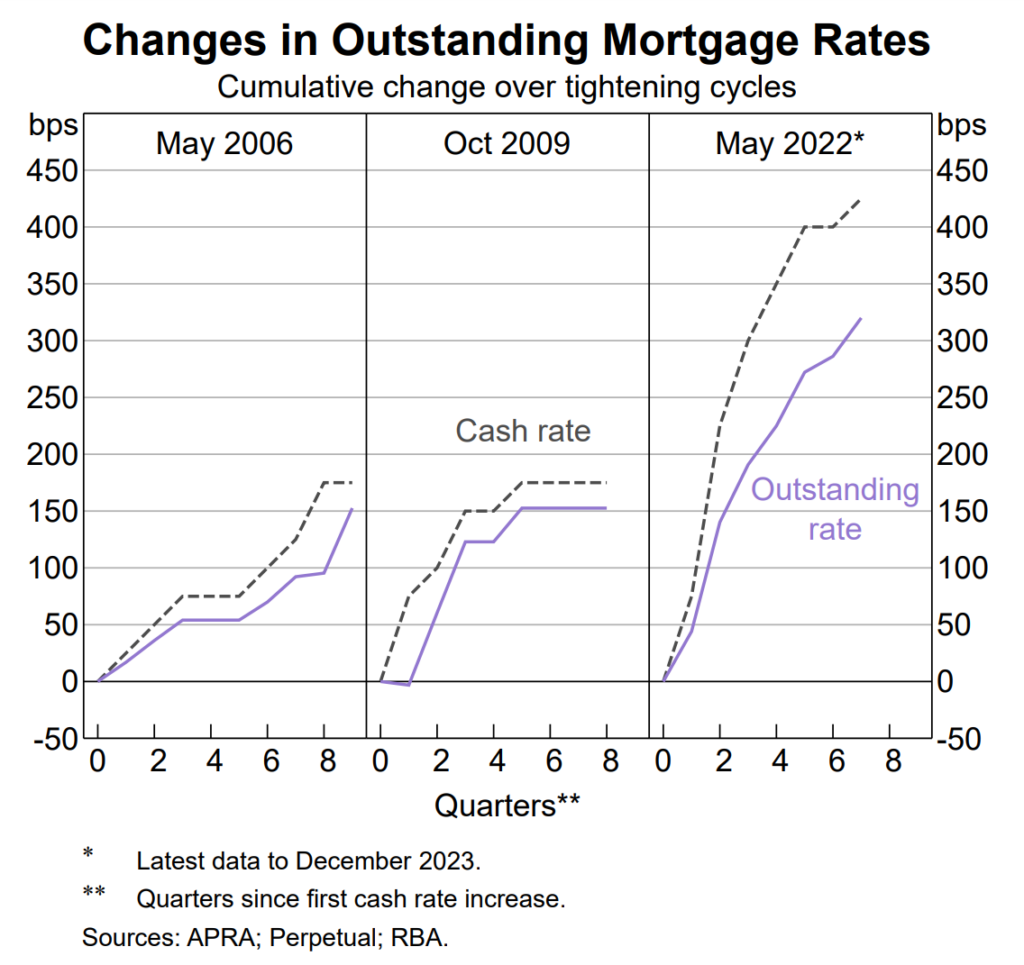

A report from the Reserve Bank of Australia details that the RBA raised the cash rate by 425 basis points between May 2022 and December 2023. The average mortgage rates increased by 320 basis points—105 basis points less than the cash rate increase. Only around 75% of the cash rate increase passed through to the average mortgage rates, unlike in previous tightening episodes where almost 90% had passed through.

This slowdown is caused by the high number of fixed-rate loans during the COVID-19 pandemic, among other factors. As these remaining fixed-rate loans expire, the pass-through rate will catch up and reflect similar numbers to previous tightening episodes.

Factors Affecting the Pass-through Rate

1. Fixed-rate Mortgages

The primary factor affecting the pass-through rate is the high proportion of fixed-rate loans during the pandemic. During that time, several policies contributed to the lowered fixed-rate offerings.

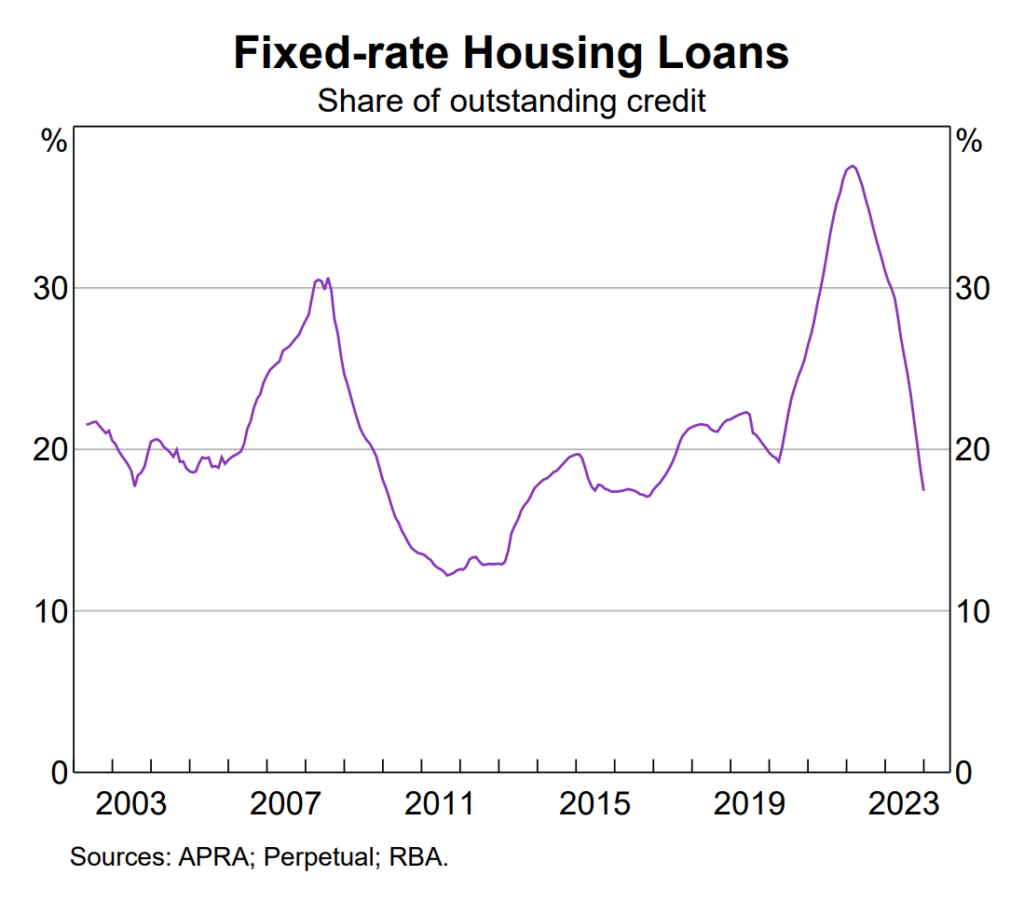

From 20%, the share of fixed-rate loans rocketed up to 40% in early 2022. Since a high share of outstanding mortgages were fixed at a low rate, the increase in the cash rates did not pass through to the mortgage rates in the same way they did during previous tightening periods.

However, the high share of fixed-rate loans has since gone down to 17% in late 2023 as more than half of the fixed-rate loans have expired. More are expected to expire throughout this year.

2. Mortgage Lending Competition

Intense competition among lenders led to smaller increases in variable rates compared to the cash rate. Lenders offered lower rates to attract or retain customers, influencing the overall slower pass-through.

The Impact on Households

The slower pass-through has stalled the increase in mortgage payments, easing the immediate financial impact on borrowers during the pandemic. As the fixed-rate loans expire, many households have started paying higher rates, affecting their finances and ability to take on future financing. As of December 2023, mortgage payments have taken up 10% of households’ disposable income. This figure is expected to rise to 10.5% within this year.

Projections

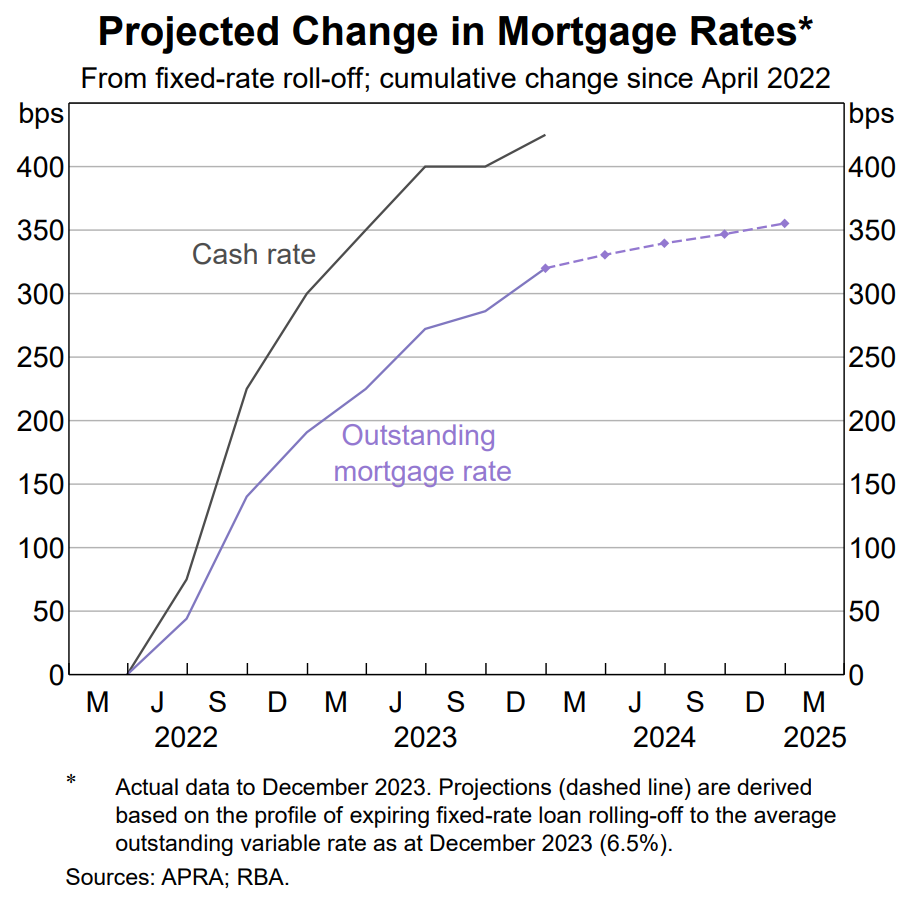

As more fixed-rate loans expire, the outstanding mortgage rate is expected to increase further.

By the end of 2024, the overall pass-through is anticipated to align more closely with past tightening episodes.

The RBA expects the average outstanding mortgage rates to increase by an additional 35 basis points.

Fixed-Rate Loans and Handling the Rollover

The majority of those who took low fixed-rate loans during the pandemic managed the rollover well. This means they didn’t feel the full effects after the switch to higher variable rates.

Fixed-rate loans protect borrowers from volatile market conditions and are a great way to manage repayments during challenging times. However, without adequate preparation, homeowners can end up unable to cover the difference in interest rates once the loan rolls over.

You should do your part as a borrower to make responsible financial choices to prepare for when your fixed-rate loan rolls over:

- Consider how long your fixed term is and make prudent choices while your mortgage repayments are low

- Use the time you have during your fixed term to save money and increase income.

- Prepare for the rollover by making smart budgeting choices.

Looking to refinance your home loan this year?

Our team of experts can help you navigate the changing economic landscape and the projected rise in average mortgage rates this year.

We’ll help you make a decision that’s best for your future.