Housing values in regional Australia have been growing faster than in the capital cities over the three months leading up to April 2024. Regional home values increased by 2.1%, while city home values rose by 1.7%. Even though city values increased, they didn’t grow as much as those in regional areas.

This period saw the strongest growth since May 2022, reaching new record highs in April. This comes after a big drop between May 2022 and January 2023.

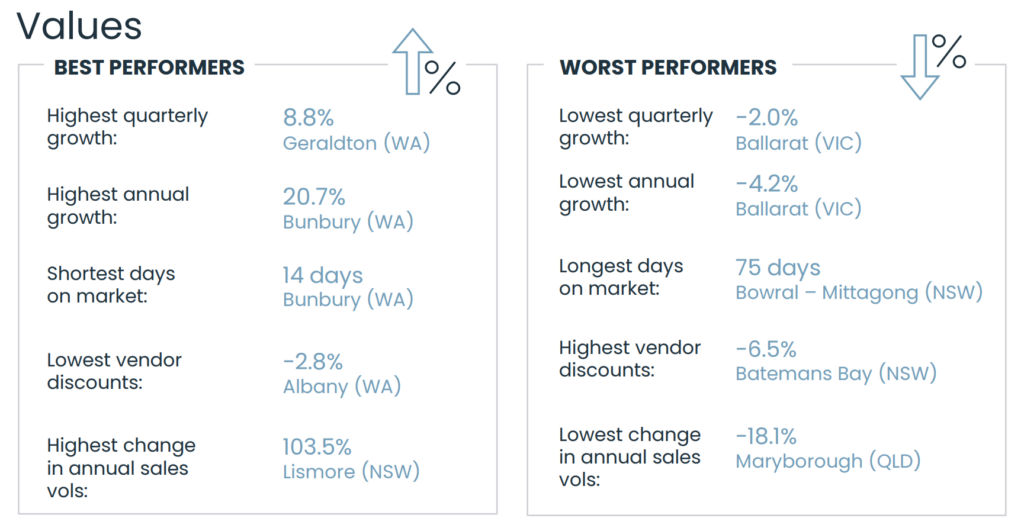

Western Australia saw the most growth, especially in Geraldton, Busselton, and Bunbury. Queensland also did well, while some New South Wales and Victoria areas declined. There was also more sales activity, with Lismore and Ballina in New South Wales showing notable increases.

Key Findings

Dwelling Value Growth

Over the three months to April 2024, regional dwelling values increased by 2.1%, compared to a 1.7% rise in capital cities. This marks the strongest quarterly growth for regional areas since May 2022. The strong growth in regional areas led to new record highs in dwelling values in April 2024, following a decline of 5.8% between May 2022 and January 2023. Western Australia led the growth, with Geraldton recording the largest quarterly rise at 8.8%, followed by Busselton (7.7%) and Bunbury (6.4%). Queensland also showed strong performance, with four markets in the top 10 for quarterly growth.

Annual Rental Growth

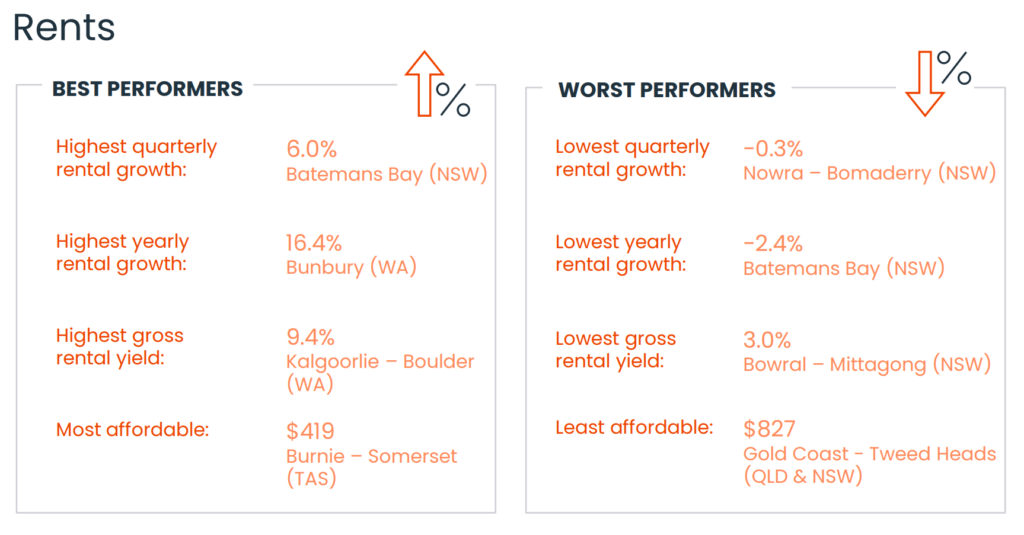

Western Australia and South Australia dominated annual rental growth, with Bunbury in Western Australia recording the largest annual increase at 16.4%, tied with South Australia’s Port Lincoln. At the other end, Batemans Bay in New South Wales recorded the highest decline, with a -2.4% annual rental growth, followed by Alice Springs in NT at -1.2%.

Sales Activity

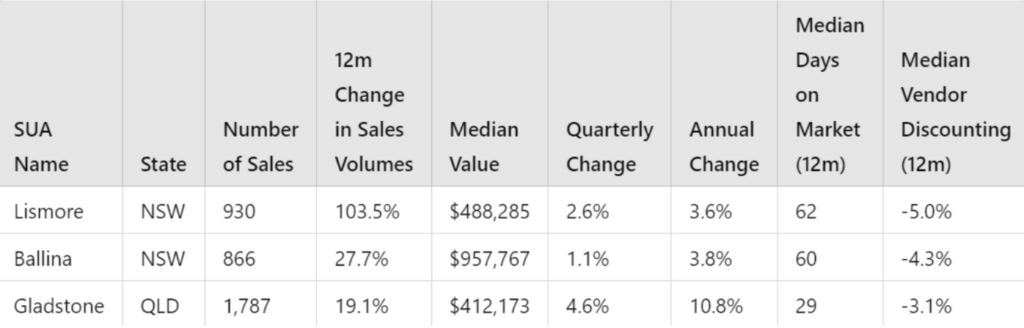

Sales activity across the 50 largest significant urban areas (SUAs) increased over the 12 months to February 2024, with 18 markets recording an annual rise in activity. Lismore (NSW) saw the largest rise in sales numbers, more than doubling (103.5%) compared to the previous year. This suggests a strong recovery from the impacts of the 2022 flood and rising interest rates.

Ballina (NSW) and Gladstone (QLD) also showed significant increases at 27.7% and 19.1%, respectively.

Market Conditions

Western Australia’s Bunbury, Busselton, and Albany regions recorded the fastest selling times over the past 12 months, with median times on the market of 14, 16, and 17 days, respectively. Queensland’s Toowoomba, Cairns, and Bundaberg also had median selling times under 20 days. Albany (WA) offered the smallest vendor discounts at -2.8%, followed by Shepparton-Mooroopna (Vic) at -2.9%. In contrast, Batemans Bay (NSW) had the highest vendor discounts at -6.5%, and Bowral–Mittagong (NSW) recorded the highest median time on the market at 75 days.

The differences in how much sellers discount their prices and how quickly homes sell in various regions show that market conditions vary greatly. Places where homes sell quickly, sellers don’t need to discount much, and are in high demand. On the other hand, areas where homes take longer to sell and sellers offer bigger discounts might be facing tougher market conditions.

Regional Highlights

Lenders typically accept various types of assets as security for bad credit loans. The specific assets accepted may vary depending on the lender’s policies and the loan amount. Here are some common forms of security:

Western Australia

Geraldton led the quarterly growth with an 8.8% increase, while Bunbury recorded the largest annual increase in dwelling values at 20.7%. Sales activity in Bunbury, Busselton, and Albany was notable for the fastest selling times, with median times on the market of 14, 16, and 17 days, respectively.

Queensland

Four of the top 10 SUAs for quarterly growth were in Queensland. Rockhampton saw the second-highest annual growth at 16.4%, while Gladstone experienced a 19.1% increase in sales activity. Fast selling times were recorded in Toowoomba, Cairns, and Bundaberg, with median selling times under 20 days.

New South Wales

Lismore experienced the largest rise in sales numbers, more than doubling compared to the previous year, while Ballina saw a significant increase in sales activity at 27.7%. On the other hand, Port Macquarie recorded a -2.0% quarterly decline, and Batemans Bay had the highest vendor discounts at -6.5%.

Victoria

Ballarat recorded a -2.0% quarterly decline and the weakest annual growth at -4.2%. In contrast, Shepparton-Mooroopna offered the second smallest vendor discounts at -2.9%, which shows relatively stable market conditions.

Market Trends and Insights

The regional markets have shown a strong recovery and growth trajectory, reaching new record highs in April 2024, particularly notable given the significant downturn experienced between May 2022 and January 2023. The variation in vendor discounts and selling times across different regions highlights the diverse market conditions, with regions experiencing higher demand having faster selling times and smaller discounts, while those with longer selling times and larger discounts may be facing more challenging market conditions.

In Summary

Regional property markets in Australia have grown faster than those in the capital cities. From February to April 2024, home values in regional areas increased by 2.1%, while in the capital cities, they only rose by 1.7%. There has also been a big increase in sales and record-high property values in many regional areas, especially in Western Australia and Queensland.

Managing Your Investments Amidst Market Changes

Looking to maximise your investment or make sure you have the lowest cost finance across your portfolio?