Key Point

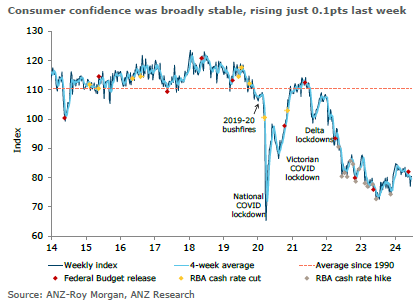

- ANZ-Roy Morgan Consumer Confidence remains stable at 80.4. Consumer confidence is at its highest since December 2011.

- Confidence has been below 85 for 73 consecutive weeks.

- Personal finances outlook for the next year has declined.

- Sentiment on buying major household items has improved.

- Economic confidence for both short-term and long-term remains low.

Consumer confidence in Australia remains stable at 80.4, as indicated by the latest ANZ-Roy Morgan Consumer Confidence survey. This level is the highest since December 2011, yet the index has been below the critical 85 mark for 73 consecutive weeks, reflecting ongoing consumer caution.

Personal Finances Outlook

Notably the survey highlights a decline in the outlook for personal finances over the next year, a key indicator of consumer spending potential. This decline suggests that Australians are feeling less optimistic about their financial future, which could lead to reduced spending and a more conservative approach to managing household budgets. The current perception of personal finances remained steady, but the drop in future expectations is concerning.

Major Household Item Sentiment

In contrast to the decline in personal finance outlook, sentiment towards buying major household items has improved. This component measures consumers’ readiness to spend on significant purchases like appliances, electronics, and furniture. An improvement here can be a positive sign for the retail sector, suggesting a willingness among consumers to invest in long-term durable goods, which often correlates with economic confidence.

In saying that, the uptick could reflect the timing of end of yinancial year sales and may well adjust lower post the end of the financial year.

Economic Confidence

Despite the mixed signals, overall economic confidence remains low. The survey measures confidence in both short-term (next 12 months) and long-term (next five years) economic conditions. The data shows that Australians are still wary about the economic outlook, with few expecting ‘good times’ ahead. This persistent low confidence can impact broader economic activities, including investment decisions, business expansion, and long-term financial planning.

Implications for the Economy

The Reserve Bank of Australia’s decision to maintain interest rates underscores the delicate balance policymakers must strike in fostering economic stability. While stable consumer confidence is a positive sign, the persistently low levels indicate that economic uncertainty continues to weigh heavily on the minds of Australians.

Personal Finance and Spending

A decline in the personal finance outlook can significantly impact consumer spending, which is a crucial driver of economic growth. When consumers feel uncertain about their financial future, they are likely to cut back on discretionary spending, affecting sectors like retail, hospitality, and entertainment. This reduction in spending can slow economic growth and reduce business revenues, potentially leading to lower investments and hiring.

Retail and Household Goods

The improved sentiment towards major household item purchases provides a glimmer of hope. Increased spending in this area can stimulate the retail sector, leading to higher sales, increased production, and potentially more jobs. If it is not reflective of end of financial year sales activity, the increase in sentiment towards major household item purchases may also reflect consumer confidence in their current financial situation, suggesting that while they may be cautious about the future, they feel secure enough to make significant purchases now.

Economic Outlook

Low economic confidence has broader implications for the economy. When consumers and businesses are pessimistic about the future, they are less likely to invest in new ventures, expand operations, or hire additional staff. This caution can lead to slower economic growth, reduced innovation, and a less dynamic economy. Policymakers must address these concerns by providing clear and consistent economic policies that instill confidence and promote stability.

Confidence Likely to Remain Low

The ANZ-Roy Morgan Consumer Confidence index offers a nuanced view of the current economic sentiment in Australia. While stability in the overall index is a positive sign, the persistently low levels of confidence reflect ongoing economic concerns. Addressing these issues requires a concerted effort from policymakers, businesses, and consumers to foster a more optimistic economic environment. With continued pressure on business it’s our expectation confidence is likely to remain low unless gains in productivity can begin to drive improvement in the broader economy.