Key Takeaways

- Interest-only loans are a type of home loan wherein the borrower pays only the interest for a set period (usually 1-5 years). Afterwards, the loan rolls over into a principal and interest repayment structure.

- This type of loan is suitable for borrowers with short-term financial needs or those expecting increased income in the future.

- Interest-only loans significantly reduce monthly repayments during the interest-only period, providing immediate financial relief.

- Interest repayments on investment properties can be tax-deductible, improving overall investment returns.

- Lower repayments allow borrowers to allocate funds to other priorities like property maintenance, investments, or personal goals.

- These loans are ideal for borrowers planning to sell their property or refinance within a few years. They also help manage financial uncertainty during life or career transitions.

- Some risks of interest-only loans include higher overall costs, the possibility of repayment shock, market risks, and having no equity built during the interest-only period.

- Interest-only loans are suitable for property investors, short-term borrowers, strategic investors, and borrowers going through transitional periods.

- Before opting for this type of loan, understand the terms by using an interest-only home loan calculator. You can also consult financial experts like Dark Horse Financial to help you navigate this loan structure.

Australian property buyers can choose from different types of home loans. One type they can select is an interest-only home loan, which is particularly attractive to those looking to optimise cash flow or maximise investment potential. Whether you’re purchasing a home or an investment property, understanding the advantages of interest-only loans can help you decide if they align with your financial goals.

What Are Interest-Only Home Loans?

An interest-only home loan is a type of mortgage where you only pay the interest portion of the loan for a specified period, typically ranging from 1 to 5 years. During this time, your monthly repayments are lower compared to a principal-and-interest loan because you are not paying down the loan balance (principal). At the end of the interest-only period, the loan transitions to a principal-and-interest repayment structure.

Example Scenario

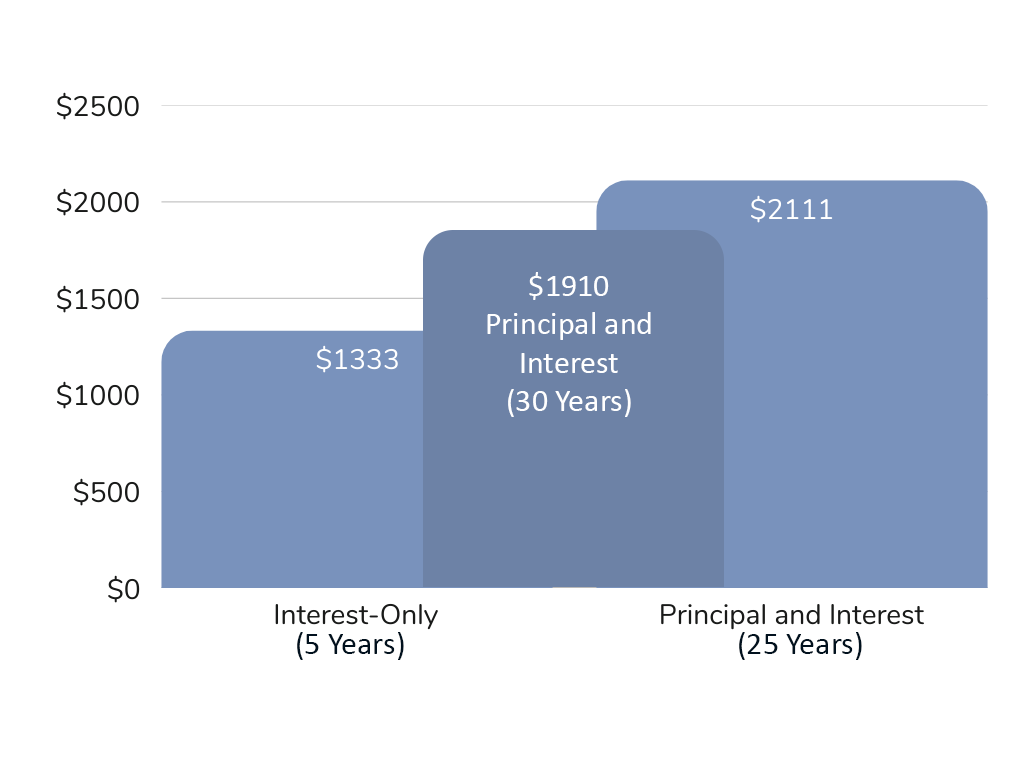

Let’s say you take out a $400,000 interest-only home loan at a 4% interest rate for a total loan term of 30 years. The loan has a 5-year interest-only period, followed by a 25-year principal-and-interest repayment period.

During the interest-only phase, you pay $1,333 per month (interest only). This saves you $577 per month (for 5 years) compared to the $1,910 you would have paid if you got a principal and interest loan for 30 years instead. After five years, the loan transitions to principal-and-interest repayments, where your monthly payment increases to approximately $2,111 for the remaining 25 years.

The Key Advantage of Interest-Only Loan in Australia

The primary advantage of an interest-only loan is its ability to lower initial repayment costs, which can be a game-changer for various types of borrowers. Let’s explore the specific benefits in detail.

1. Lower Monthly Repayments (During Interest-Only Period)

During the interest-only period, borrowers pay only the interest component of the loan, which significantly reduces the monthly repayment amount. This provides immediate relief to cash-strapped borrowers or those managing multiple financial commitments. For investment-savvy borrowers, lower repayments mean they can allocate cash to other income-generating investments.

2. Tax Benefits of Interest Only Mortgages for Investment Properties

One of the significant tax benefits of interest-only mortgages comes into play when the loan is for an investment property. In Australia, property investors can claim tax deductions on the interest paid on their loans. Since the repayments during the interest-only period are entirely interest, the full repayment amount can be tax-deductible (subject to Australian Taxation Office rules). This tax efficiency can improve the overall return on your investment property, making interest-only loans a strategic choice for investors.

3. Improved Cash Flow for Investors

An interest-only loan for investment properties can improve cash flow significantly. With lower repayments during the interest-only period, investors can allocate funds to property-related expenses such as maintenance, upgrades, or even acquiring additional properties.

Example Scenario

An investor owns a rental property generating $2,500 in monthly rental income. With an interest-only loan, the monthly repayment is $2,083, leaving a surplus of $417. In contrast, a principal-and-interest loan repayment of $2,684 would result in a negative cash flow of $184. The investor can use the $417 on other expenses and can even reinvest it into another property.

4. Flexibility in Financial Planning

The reduced repayments during the interest-only period offer flexibility in managing finances. Borrowers can choose to use the saved funds for:

- Investing in shares or other assets.

- Funding a business.

- Saving for personal goals such as travel or education.

- Making additional repayments on higher-interest debts.

5. Strategic Use for Short-Term Needs

Interest-only loans are ideal for borrowers with short-term financial goals or expectations of increased income in the near future. For example:

- A professional anticipating a salary increase may opt for an interest-only loan to reduce repayments until their income rises.

- Homeowners planning to sell their property within a few years can benefit from lower repayments without committing to long-term principal payments.

6. Bridging Periods of Financial Uncertainty

For borrowers facing temporary financial uncertainty, such as career transitions or economic downturns, interest-only loans provide a buffer by lowering repayment obligations. This can help borrowers maintain their property without financial strain.

Risks to Consider

While there are plenty of advantages to interest-only loans, it’s important to be aware of the potential risks:

- Higher Total Interest Costs: Since the loan principal is not reduced during the interest-only period, borrowers may pay more in total interest over the life of the loan.

- Repayment Shock: When the loan transitions to principal-and-interest repayments, the monthly repayment amount increases significantly. Borrowers should plan for this adjustment.

- No Equity Built: During the interest-only period, you will not be building equity since you are not reducing the principal debt.

- Market Risks: In a declining property market, the lack of equity growth can leave borrowers vulnerable to negative equity (owing more than the property’s value).

When Is an Interest-Only Loan a Good Choice?

Interest-only loans can be a good fit for:

- Property Investors: This choice is great for investors seeking to maximise tax benefits and cash flow.

- Short-Term Borrowers: This type of loan is perfect for buyers who are planning to sell the property or refinance within a few years.

- Strategic Investors: Interest-only loans are good for those looking to leverage funds for other investments or financial goals.

- Borrowers Going Through Transitional Periods: This is a great choice for those in between changing careers or any major life change and can benefit from the reduced repayments in the short term.

How to Evaluate an Interest-Only Loan

Before opting for an interest-only loan, consider the following:

- Understand the Terms: Review the loan’s terms, including the length of the interest-only period and the post-transition repayment amounts.

- Use an Interest-Only Home Loan Calculator: With our interest-only calculator, you can estimate repayments and compare them with principal-and-interest loans.

- Consult a Financial Expert: Professionals like Dark Horse Financial can help assess the loan’s suitability for your financial situation.

In Conclusion

Interest-only loans provide financial flexibility, improve cash flow, and maximise investment potential for Australian borrowers. While these loans are not without risks, they can be a strategic tool for borrowers with specific financial goals. Whether you’re a property investor or a homeowner seeking short-term financial relief, understanding interest-only loans can help you make informed financial decisions. If you’re considering an interest-only loan, use tools like an interest-only home loan calculator and consult with financial professionals to tailor the loan to your needs.

Disclaimer: The information provided on this page is general in nature and does not constitute financial, taxation, or legal advice. It does not take into account your personal circumstances, objectives, or needs and should not be relied upon for any reason. Before making any decisions, you should seek independent professional advice tailored to your specific situation.