Key Takeaways

- The types of heavy equipment financing in Australia include chattel mortgage, finance lease, hire purchase, and rent-to-own, each offering different tax benefits, ownership structures, and flexibility.

- Choosing the right heavy equipment loan in Australia depends on business needs, cash flow, and long-term plans for the equipment.

- Heavy equipment loans help businesses acquire machinery while preserving working capital and improving cash flow management.

- Financing covers various machinery, including construction equipment, transport trucks, mining machinery, and agricultural tools, ensuring businesses stay operational.

- Interest rates, loan terms, and balloon payments impact total repayment costs, making it essential to compare options carefully.

- Tax benefits such as GST claims, depreciation deductions, and the Instant Asset Write-Off can significantly reduce financing costs.

- Heavy equipment lending experts like Dark Horse Financial help businesses secure competitive heavy equipment loan options tailored to their specific needs.

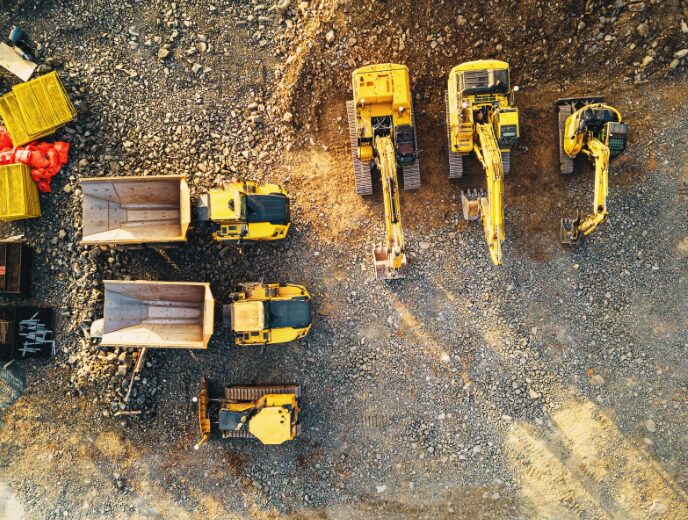

Heavy equipment financing helps businesses acquire essential machinery without large upfront costs. No matter if you’re in construction, transport, or agriculture, securing the right finance ensures smooth operations, better cash flow, and potential tax advantages.

But how do you know which type of financing suits your business best?

What Are the Types of Heavy Equipment Loans in Australia

Heavy equipment financing options in Australia include chattel mortgage, finance lease, hire purchase, and rent-to-own.

Some provide ownership from day one, while other types of heavy equipment financing loans focus on flexibility and cash flow management. Here’s a breakdown:

Chattel Mortgage

A chattel mortgage allows businesses to purchase heavy equipment while using it as security for the loan. Once the loan is repaid, full ownership transfers to the borrower and the lender removes the mortgage from the Personal Property Securities Register (PPSR).

- You own the equipment from the start.

- Fixed interest rates provide predictable repayments.

- Potential tax benefits, including GST claims and depreciation deductions.

- Balloon payments may be available to lower monthly repayments.

Best for: Businesses that want ownership while benefiting from structured payments and tax deductions.

Finance Lease

A finance lease gives your business access to heavy machinery without immediate ownership. The lender owns the equipment, and you lease it for a fixed period, paying regular instalments. At the end of the lease, you can choose to return, extend, or purchase the equipment at its residual value.

- No upfront capital required.

- Fixed payments help with cash flow management.

- Potential tax benefits since lease payments are deductible.

Best for: Businesses that want flexibility without immediate ownership responsibilities.

Hire Purchase

A hire purchase agreement allows businesses to hire equipment and make payments over time, eventually gaining ownership at the end of the contract.

- Structured repayments with ownership transfer after final payment.

- Tax benefits may apply, similar to a chattel mortgage.

- Balloon payments can be included to lower monthly costs.

Best for: Businesses that want to eventually own their equipment but need structured repayments.

Rent-to-Own

A rent-to-own option is a flexible arrangement where businesses rent equipment with the option to purchase later. A portion of the rental payments contributes toward the final purchase price.

- No immediate commitment to purchase.

- Great for businesses with limited credit history.

- Allows companies to test equipment before buying.

Best for: Startups or businesses that need flexible financing without long-term obligations.

What are the Types of Heavy Equipment in Australia

The right types of heavy equipment financing can support essential assets like excavators, semi-trailers, and tractors, ensuring businesses stay operational while managing cash flow effectively.

Here are a few examples:

Construction Equipment

- Excavators

- Bulldozers

- Backhoes

- Cranes

- Loaders

- Concrete mixers

Transport & Logistics Equipment

- Semi-trailers

- Heavy-duty trucks

- Forklifts

- Refrigerated trucks

- Tanker trucks

Mining Equipment

- Drilling rigs

- Dump trucks

- Crushers

- Conveyors

- Underground loaders

Agricultural Machinery

- Tractors

- Combine harvesters

- Balers

- Sprayers

- Irrigation systems

These assets are essential for various industries, and the right types of heavy equipment financing can be structured based on business needs, repayment capacity, and long-term growth plans.

How to Secure Heavy Equipment Loans in Australia

1. Assess Your Business Needs

Before applying for heavy equipment financing, determine:

- The exact type of equipment required.

- Whether ownership is essential or if leasing makes sense.

- How financing repayments fit into your cash flow.

You can use our equipment finance calculator to better understand how much you’ll pay in monthly repayments. (Results are based on estimates and can differ from actual cost depending on the lender and other factors)

2. Compare Loan Options

Each financing type has its advantages. A chattel mortgage suits businesses looking for long-term ownership, while leasing provides more flexibility. Reviewing all options ensures you get the right financial structure.

3. Check Loan Eligibility

Lenders assess:

- Business credit score.

- Financial history and revenue.

- Equipment details (age, condition, and value).

4. Work with a Finance Broker

Rather than handling multiple lender options alone, working with an expert ensures tailored solutions. Dark Horse Financial, for example, helps businesses secure the best heavy equipment loan in Melbourne and across Australia by negotiating with lenders to obtain favourable terms.

Call us on 0439062771 to help you explore the best options available.

5. Understand Loan Terms

- Compare interest rates.

- Consider balloon payments and residual values.

- Review tax implications and deductions.

6. Apply and Finalise Financing

Once you’ve chosen the best loan type of heavy equipment financing, prepare documents (if required), submit your application, and finalise the agreement. After approval, the equipment is ready for business use.

Factors That Influence Heavy Equipment Loan Terms

1. Interest Rates

- Business financials and credit score impact rates.

- New equipment often qualifies for better terms than older machinery.

- Loan amounts and terms can affect interest rates.

2. Loan Term Length

- Typical repayment terms range from 3 to 7 years.

- Longer terms mean lower monthly payments but may incur higher interest costs over time.

3. Balloon Payments

A balloon payment reduces monthly instalments by deferring a larger sum to the end of the loan. It’s useful for cash flow management but requires planning for the final lump sum.

Tax Benefits of Heavy Equipment Financing

- Chattel mortgage holders can claim GST and depreciation benefits.

- Lease payments are fully tax-deductible as operating expenses.

- The Instant Asset Write-Off Scheme may apply to eligible purchases, allowing businesses to claim immediate deductions.

Understanding these benefits helps your business save money and optimise your financial strategy.

Avoiding Common Heavy Equipment Financing Mistakes

- Choosing the Wrong Financing Type – Leasing might be a better option than buying, depending on business needs.

- Not Reviewing Loan Terms – Hidden fees and restrictive clauses can impact financial flexibility.

- Overlooking Interest Rates – Higher rates can significantly affect total repayment costs.

- Ignoring Cash Flow Considerations – Ensure repayments fit within the business’s revenue structure.

- Forgetting Long-Term Costs – Maintenance and depreciation should be factored into financing decisions.

FAQs About Types of Heavy Equipment Financing

What are the types of heavy equipment loans available in Australia?

The main options include chattel mortgage, finance lease, hire purchase, and rent-to-own. Each has unique benefits, depending on business needs.

Can I finance used heavy equipment?

Yes, but lenders assess age, condition, and resale value before approving finance.

How long are equipment finance terms?

Terms typically range from 3 to 7 years, depending on the lender and equipment type.

Can I get financing with bad credit?

Yes, some lenders provide alternative financing solutions, but interest rates and terms may be less favourable.

What happens at the end of a finance lease?

You can choose to return, extend, or purchase the equipment at an agreed residual value.

Quick Recap

Heavy equipment financing in Australia keeps businesses moving without the burden of upfront costs. Choosing the right option means balancing cash flow, tax benefits, and long-term financial stability.

A well-planned financing strategy ensures businesses get the right type of heavy equipment financing without straining resources.

Dark Horse Financial simplifies the process with expert guidance and access to competitive lending solutions. Whether you need a chattel mortgage, lease, or hire purchase, we tailor financing to suit your business needs.

Get the Right Heavy Equipment Financing for Your Business

Securing the right type of heavy equipment loan helps your business grow without draining cash flow. Whether you need ownership, flexibility, or a low upfront cost, there’s a solution that fits. Loan experts can help you compare options and structure the right finance plan—so you can keep moving forward with confidence.