Key Takeaways

- Lenders use the DSCR to figure out how likely it is that your business can pay back its debts.

- When banks and other lenders look at business loan applications, they pay close attention to the DSCR.

- It helps lenders decide whether to approve a loan and how much to lend, what the interest rates and terms should be, and what the loan amount should be.

- To get the DSCR, you divide a business's net operating income by its total debt service. A ratio greater than 1 is good, while a ratio less than 1 is bad.

- A ratio of exactly 1 tells lenders that your business can handle debts right now, but it might not be able to handle any unexpected financial problems in the future.

- A good DSCR can help you get a loan with better terms overall. If your DSCR is too low, the lender might look into your situation more closely. If the loan is approved, it may have higher rates and less favourable terms.

- A low DSCR can cause a loan to be turned down. It might get approved in some cases, but the loan terms won't be as good.

- Businesses can raise their DSCR by paying off their debts and making their finances better in general. This means better cash flow and better management of working capital.

If you run a business and want to borrow funds, you need to know what the debt service coverage ratio (DSCR) is. The DSCR is a key financial metric that shows how well a company can handle its debts, and lenders keep a close eye on it. Your business’s DSCR can help you get a loan or not. Let’s talk about the details of this important ratio.

What does the Debt Service Coverage Ratio Mean?

The Debt Service Coverage Ratio (DSCR) is a number that shows how well a business can use its operating income to pay off all of its debts, including the interest and principal on both short- and long-term loans. This is a key number for lenders and investors to look at when they want to know how safe it is to lend money to or invest in a company.

Why is the DSCR Important for Business Loans?

When lenders look at business loan applications, the DSCR is a very important factor. It has a number of important roles in the process of deciding who to lend funds to:

- The DSCR shows lenders how likely a business is to be able to make its debt payments on time, even if its revenue or cash flow changes.

- Businesses with a higher DSCR usually qualify for bigger loans with better terms, like lower interest rates and longer repayment periods.

- Lenders use the DSCR to figure out how risky a loan is overall. A lower ratio means that the borrower is more likely to not pay back their debts.

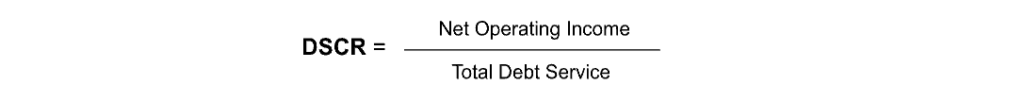

How is the DSCR Calculated?

The debt service coverage ratio is calculated using the following formula:

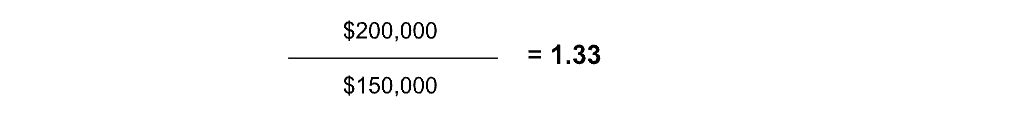

For example, if a company has $200,000 in operating cash flow but $150,000 in annual interest and principal payments, the DSCR would be:

What it Means:

DSCR is Above 1: Favourable

- Signals to lenders that the company is in good financial standing and can responsibly manage additional debt

DSCR is 1: Minimum

- Indicates to lenders that the company generates just enough income to meet its debt obligations, but it may not be able to handle fluctuations or downturns in the future

DSCR is Below 1: Unfavourable

- Indicates to lenders that the company may have difficulty servicing its existing and new debt obligations

In the example above, the company has a favourable DSCR of 1.33, which means its net income can successfully cover its debt obligations.

The Impact of DSCR on Business Loan Approval

The debt service coverage ratio is an important part of getting a business loan. It can decide if your loan will be approved and what terms the lender will give you. Here’s how the DSCR can affect whether or not you get a loan:

Good DSCR (Above 1)

This shows that a business can make enough money to pay off its debts, even if things change. So, it makes it more likely that your loan will be approved and that you will get better terms, like lower interest rates and longer repayment periods. Many lenders prefer to lend to businesses with a DSCR of more than 1.25, even though ratios above 1 are already good.

Minimum DSCR (1)

If your DSCR is on the edge, lenders might still approve your loan, but they might look more closely at other parts of your business’s finances. If you get the loan, it might have a higher interest rate, a smaller amount, and stricter rules. Sometimes, lenders might want a property or asset as security.

Low DSCR (1 or less)

A low ratio makes lenders worry that the business won’t be able to pay its debts on time and stay financially stable. This often means that the loan is turned down or, at best, the terms are less favourable.

Businesses can show that they are financially responsible and creditworthy by keeping a healthy DSCR. This will increase their chances of getting the funds they need to grow and succeed.

Strategies to Improve Your Business's DSCR

If your business’s current DSCR doesn’t meet lender expectations, you can take some steps to improve it and increase your chances of approval:

- Lower your debt obligations by paying off or refinancing high interest loans and lines of credit. Doing so will lower the amount you need to pay each month, lowering your DSCR.

- Implement growth strategies to boost your company’s revenues and profitability.

- Improve inventory management, accounts receivable, and accounts payable processes to free up cash flow and reduce debts.

- Securing longer repayment periods can lower your annual debt service requirements and improve the DSCR.

- Work with experienced business loan professionals who can help you strategise the best ways to optimise your DSCR and present it effectively to potential lenders.

Navigate Business Loan Applications with Expert Guidance

When lenders look at business loan applications, they pay close attention to the DSCR.

You can greatly increase your chances of getting a loan by knowing how it is figured out and how to improve it.

Loan experts like Dark Horse Financial can help you understand what different lenders need from you, from your DSCR to your business's finances and credit score. We can help you show your business's finances in the best light possible so you can get the funding you need.

Disclaimer: Loans and the benefits associated with them are only available to those who have been approved. The information provided on this page is general and does not consider your individual circumstances. It is not meant to serve as a substitute for professional advice, and you should not rely on it for any decisions. Always consult with a professional regarding finance, tax, and accounting matters before making any choices or taking action.