Key Takeaways

| Key Point | Description |

|---|---|

| Definition | The debt service coverage ratio (DSCR) measures a business’s ability to generate sufficient cash flow to cover its debt obligations. Lenders, particularly banks , closely examine DSCR when evaluating business loan applications. |

| Why is the DSCR Important in Business Loans? | The DSCR helps lenders assess your business’s capacity to repay debts. It helps lenders decide loan approval and what loan amounts, interest rates, and terms to give. |

| How is the DSCR Calculated? | The formula for DSCR is a business’s net operating income divided by its total debt service. A ratio above 1 is favourable, while anything below 1 is unfavourable. A ratio of exactly 1 tells lenders that your business may be able to handle debts now, but it may not survive any unexpected financial circumstances in the future. |

| Impact of DSCR on Business Loan Approval | A favourable DSCR can lead to loan approval with better overall terms. A minimum DSCR may lead to more scrutiny from the lender. If approved, the loan may have higher rates and less favourable terms. As for a low DSCR, this can lead to loan rejection. In some cases, it may lead to approval, but the loan terms will be less ideal. |

| Strategies to Improve DSCR | Businesses can improve their DSCR by reducing their debt obligations and improving their overall financial state. This includes improving cash flow and managing working capital more effectively. |

As a business owner applying for business loans, understanding the debt service coverage ratio (DSCR) is crucial. The DSCR is a key financial metric closely scrutinised by lenders to assess a company’s ability to manage its debts. Your business’s DSCR can determine whether or not you’ll get loan approval. Let’s dive into the details of this important ratio.

What is the Debt Service Coverage Ratio?

The Debt Service Coverage Ratio (DSCR) is a financial ratio that measures a company’s ability to use its operating income to cover all its debt obligations, including repayment of principal and interest on both short-term and long-term debt. It is a critical metric for lenders and investors to assess the financial health and risk associated with lending to or investing in a company.

Why is the DSCR Important for Business Loans?

The DSCR is a critical factor for lenders when evaluating business loan applications. It serves several key purposes in the lending decision-making process:

- Assessing Debt Repayment Ability: The DSCR provides lenders with a clear indication of a business’s ability to make timely debt payments, even in the face of potential fluctuations in revenue or cash flow.

- Determining Loan Amounts and Terms: A higher DSCR typically enables businesses to qualify for larger loan amounts and more favourable terms, such as lower interest rates and longer repayment periods.

- Evaluating Risk Profile: Lenders use the DSCR to gauge the overall risk of a loan, as a lower ratio suggests a higher likelihood of the borrower defaulting on their debt obligations.

How is the DSCR Calculated?

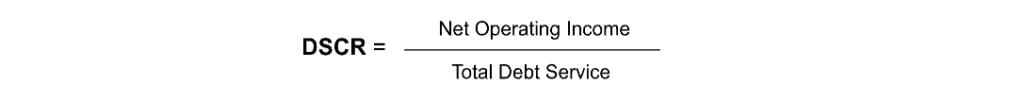

The debt service coverage ratio is calculated using the following formula:

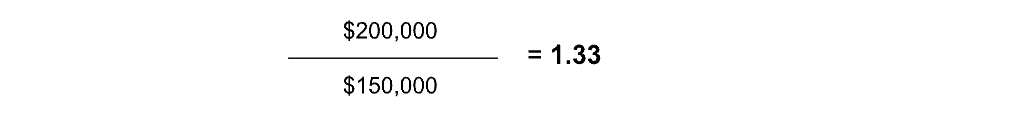

For example, if a company has $200,000 in operating cash flow but $150,000 in annual interest and principal payments, the DSCR would be:

What it Means:

DSCR is Above 1: Favourable

Signals to lenders that the company is in good financial standing and can responsibly manage additional debt

DSCR is 1: Minimum

Indicates to lenders that the company generates just enough income to meet its debt obligations, but it may not be able to handle fluctuations or downturns in the future

DSCR is Below 1: Unfavourable

Indicates to lenders that the company may have difficulty servicing its existing and new debt obligations

In the example above, the company has a favourable DSCR of 1.33, which means its net income can successfully cover its debt obligations.

The Impact of DSCR on Business Loan Approval

The debt service coverage ratio is a critical factor in the business loan approval process. It can determine whether your loan will be approved and what terms you will get from a lender. Here’s how the DSCR can impact loan approval:

Favourable DSCR (Above 1)

- This demonstrates a business’s capacity to generate sufficient cash flow to cover its debt obligations, even in the face of potential fluctuations. Thus, it increases the likelihood of loan approval and access to more favourable terms, such as lower interest rates and longer repayment periods. Although ratios above 1 are already ideal, many lenders are more comfortable lending to businesses with a DSCR of above 1.25.

Minimum DSCR (1)

- A borderline DSCR can lead to approval, but lenders may scrutinise other aspects of your business financials more carefully. If approved, the loan may come with a higher interest rate, smaller loan amount, and stricter covenants. In some cases, lenders may ask for a property or asset as security.

Low DSCR (Less than 1)

- A low ratio raises concerns about the business’s ability to make timely debt payments and maintain financial stability. This often results in loan denial or, at best, less favourable terms.

By maintaining a healthy DSCR, businesses can demonstrate their financial discipline and creditworthiness, ultimately improving their chances of securing the financing they need to grow and thrive.

Strategies to Improve Your Business's DSCR

If your business’s current DSCR is not meeting lender expectations, there are several strategies you can implement to improve it:

- Reduce Debt Obligations: Pay down or refinance high-interest loans and lines of credit to lower your total debt service requirements.

- Increase Cash Flow: Implement growth strategies to boost your company’s revenues and profitability.

- Optimise Working Capital Management: Improve inventory management, accounts receivable, and accounts payable processes to free up cash flow and reduce debts.

- Negotiate Longer Loan Repayment Terms: Securing longer repayment periods can lower your annual debt service requirements and improve the DSCR.

- Consult with Lending Experts: Work with experienced business loan professionals who can help you strategise the best ways to optimise your DSCR and present it effectively to potential lenders.

Navigate Business Loan Applications with Expert Guidance

The DSCR is an important metric that lenders examine when evaluating business loan applications. By understanding how it’s calculated and how to improve it, you can significantly enhance your chances of loan approval.

Consulting with loan experts like Dark Horse Financial can be invaluable in navigating the requirements of various lenders, from the DSCR to your business financials and credit history. We can help you present your business’s financial profile in the best light possible so you can secure the funding you need.