Using business finance to source older equipment is a great solution for many business owners.

With imports impacted by slowdowns and dock issues, there’s a real shortage of vehicles and some equipment. This has put upward pressure on the value of assets and as a consequence, we’re seeing a number of business owners turn to the second-hand equipment market, and roll over their existing equipment and machinery rather than buy new.

But if you’ve ever looked to other equipment finance options such as older assets and vehicles to keep your business operating you know that major banks have a preference for financing equipment that is new stock. So what to do to get an equipment finance loan for an older asset?

How to get equipment finance on older equipment and machinery

Knowing that older stock often has a useful lifespan that’s beyond what the major banks wish to finance doesn’t mean you’re at a dead end. There are a number of lenders who fill this space and are happy to provide equipment finance against older assets.

This includes rolling over a balloon payment that’s coming up at the end of an existing finance term or raising capital against assets for longer terms and lower rates than those offered by unsecured loans.

Can I cash out equity in existing equipment?

A sale and leaseback is a solution we’ve helped business owners with to raise capital. The lender will take a valuation of your asset and offer cash against the value which you pay back over a 3 to 5 year term in the same way you would any other equipment finance.

This will result in longer terms available and with much lower rates than unsecured loans offer while still avoiding using residential property as security. The benefit of this is a business equipment loan that is much kinder to cash flow.

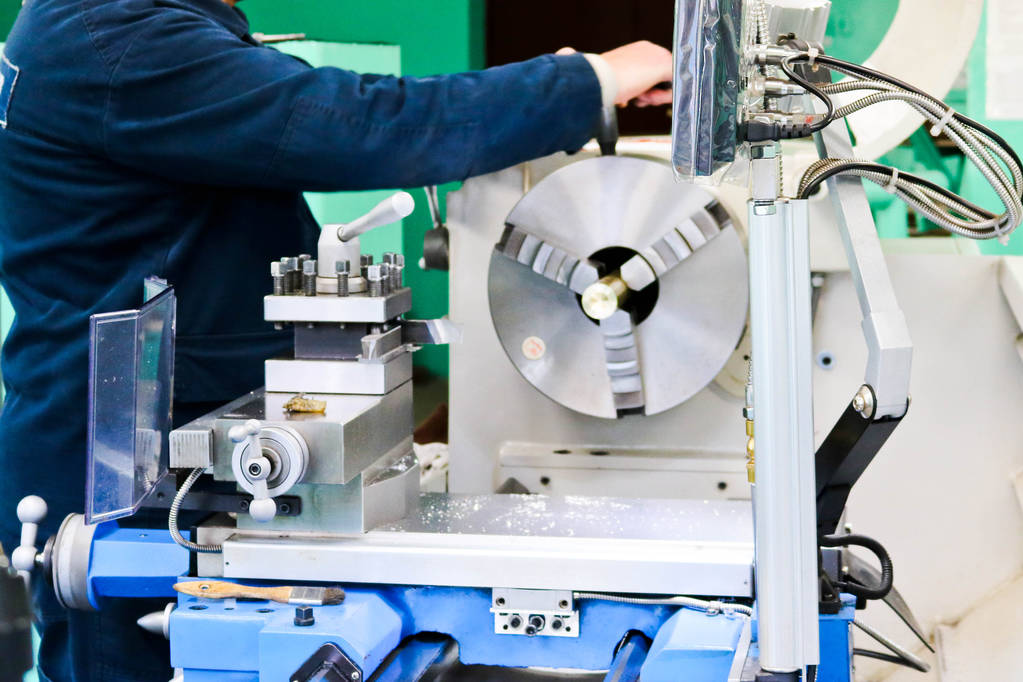

What kind of older assets can I utilise with my equipment finance?

There are so many different lenders with different appetites these days that if you can see it you can finance it.

Beyond cars and trucks, we’ve also financed yellow assets, specialist engineering equipment, industrial food manufacturing machines, packaging lines, lifting equipment and much, much more.

What if I have an ATO debt or my financials aren’t up to date?

It’s true that some lenders will want their customers to be up to date with the ATO but for others they’re happy if there is a payment plan in place. Some lenders will look at each business on a case-by-case basis meaning that even without a payment plan we can successfully finance equipment for a business if you have a debt with the ATO.

The same is true if your financials aren’t up to date. Increasingly, lenders are making assessments by reviewing 6 or 12 months’ worth of bank data and won’t need your financials to make a decision.

Final thoughts on equipment financing for older assets

Older equipment and machinery can be a great asset to your business finances and there’s normally a finance solution to match your situation such as an equipment loan. The key takeaway is to be upfront about your circumstances with your finance expert to get the best equipment loans for your business.

How we are providing equipment financing solutions for our clients

Here’s a list of some of the solutions we’re doing for clients at the moment.

- $300k to payout tax debt and extend the repayment term to 3 years as the ATO payment plan was too short.

- $130k car finance to a credit impaired director

- $2.8M low doc loan with repayments against farm land while a rezoning application is processed

- $2.4M low doc loan with no repayments for 12 months to pay out tax debt and prevent adverse action by the ATO against the director and their personal assets

- $300k no doc loan for working capital while a business restructured

- $2.1M home and investment loan refinance

Talk about your business equipment finance with an expert

Get in touch today to talk through your business finance options and receive an equipment loan that is right for your business.

Commercial Lending Solutions For Your Business

OVERDRAFTS | TERM LOANS | UNSECURED LENDING | EQUIPMENT FINANCE | PROPERTY FINANCE | CASH FLOW LENDING | WORKING CAPITAL | BRIDGING LOANS | PRIVATE LENDING

The finance you need to do business the way you want

.

Related Links

How to use equipment and asset finance for business growth