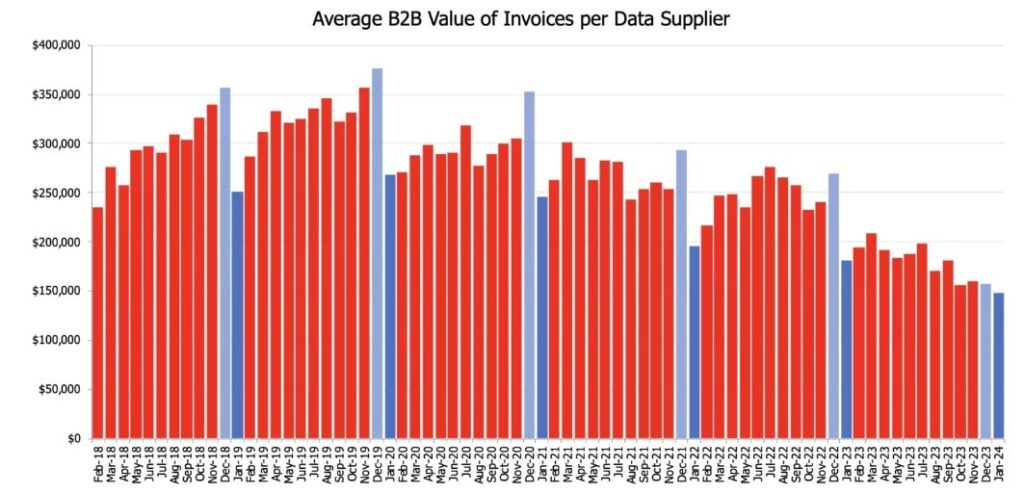

Data source: CreditorWatch trade receivables data (accounting software integration)

Creditorwatch BRI Report Reveals Record Dip in Business Order Values

| Key Points | Description |

|---|---|

| Business Order Values Record Low | The CreditorWatch BRI report this January 2024 reveals a concerning dip in business order values. The value of B2B invoices has fallen to a record low, a 19% decrease from January last year. Trade defaults also keep rising, reflecting businesses lowered capacity to make payments. |

| Why It’s Happening | Trading usually spikes from around November to December each year, which tapers off and lowers come January. However, for 2023, this Christmas flush did not happen, especially affecting those that rely on this trade to sustain them for the rest of the year. With the high cost of living, people have chosen to prioritise essential expenses over Christmas and holiday spending. |

| Regional Data | The regions most at risk of business insolvencies are around NSW and South East Queensland, which are areas with younger populations that have less discretionary income. Meanwhile, areas with the least risk of business failure are in Victoria, inner Adelaide, and North Queensland. These areas have older populations that are more likely to be well established and debt-free. |

| 2024 Outlook for Businesses | Businesses like restaurants, cafes, and accommodations are most at risk of insolvency this year as Australians choose to stay home. The security industry is also at risk due to tight competition. Meanwhile, agriculture, healthcare, and financial services will remain strong this year and are at the least risk of business failure. |

| How Businesses Can Survive | Business owners can apply strategies to survive this year’s economic landscape, starting with enhanced financial planning, business expansion, and customer retention efforts. Businesses can also take advantage of government initiatives and seek the help of financial professionals. |

| The Role of Loans in Business Growth and Stability | Business loans and lines of credit can support businesses meet operational expenses, payout tax and consolidating other outstanding accounts. |

The January 2024 report from the CreditorWatch Business Risk Index reveals some concerning numbers for Australian business. The value of B2B invoices has decreased by 19% from January 2023, hitting a record low. B2B trade order defaults also continue to rise, with a 55% year-on-year increase, which indicates a number of businesses are struggling.

External administrations also rose in January, with businesses now failing at a rate higher than before the pandemic. Overall, it’s a very challenging time for many Australian businesses, and all signs point to this trend continuing for the rest of 2024.

Why It’s Happening

It’s natural for trading activity to decrease from December to January after the Christmas surge in spending. However, in 2023, the expected spike during the holidays didn’t happen. Many businesses rely on the holiday spike to get them through the next year, but from November to December 2023, instead of rising, sales dipped slightly by 2.7%.

Due to inflation and high interest rates, consumers are struggling financially. With high costs of living, both consumers and businesses are less optimistic about their finances and the general state of the economy. Consumers are now choosing to spend their limited income on necessities and forgoing less important expenses.

Regional Data

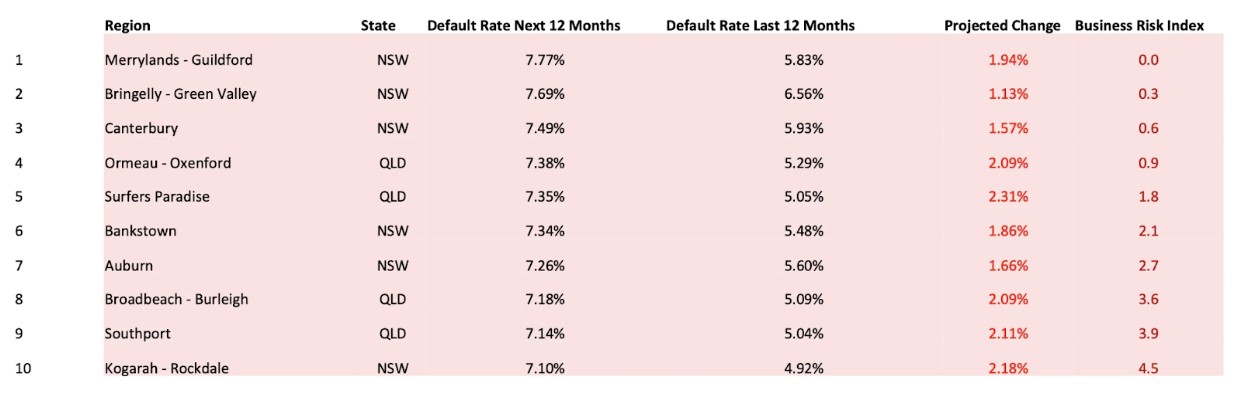

The regions with businesses most at risk of insolvency are Merrylands-Guildford, Bringelly-Green Valley, and Canterbury. These areas have mostly younger residents who are less likely to be well established financially. Younger residents tend to be more affected by inflation and rising interest rates as they are more likely to have less income and more debt than others leading to a lower capacity for non-essential spending.

Table from CreditorWatch

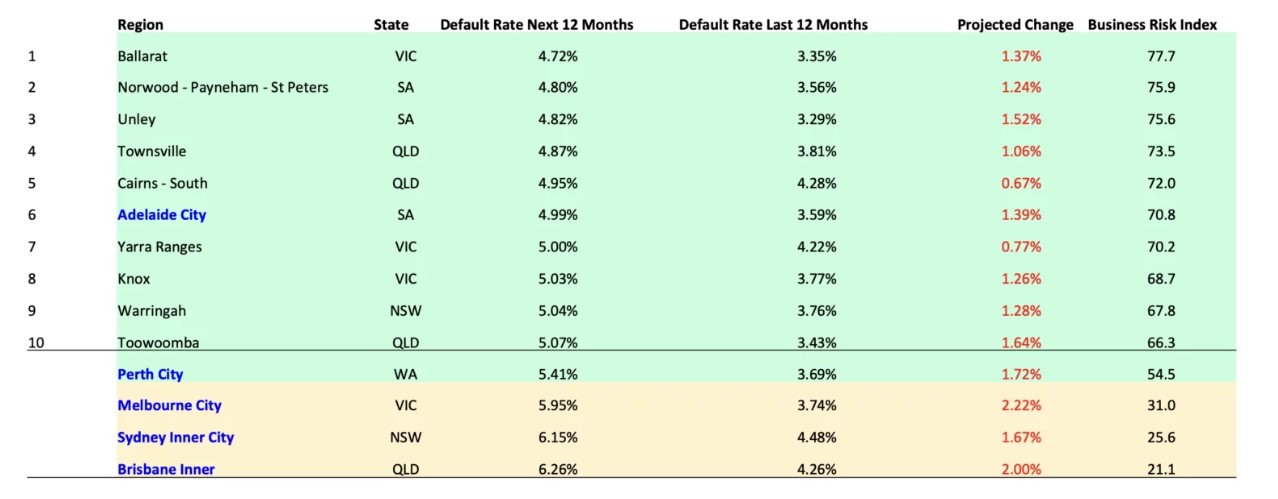

Meanwhile, the regions with the lowest risk are Ballarat, Victoria, inner Adelaide, and North Queensland. It’s worth noting that the areas with the least risk of business insolvency are those with older populations that are less likely to have mortgages or other debts. Without substantial repayments to make, the residents of these areas have larger discretionary income that can keep flowing to business.

Table from CreditorWatch

2024 Outlook for Businesses

This year is projected to be a very difficult period for Australian businesses. As consumers lose confidence in their ability to afford their regular expenses, trade will continue to slow down as people prioritise where their money goes.

The industries at most risk of business failure this year are food and beverage services, public administration and safety, and accommodation. Australians are choosing to stay home and avoid eating out or going to cafes. Meanwhile, security industries are struggling under the pressure of competition.

The industries with the least likelihood of business failure are agriculture, forestry, and fishing as well as healthcare, social assistance, and financial services. These are essential industries that have a better chance of staying strong even during challenging economic situations.

How Businesses Can Survive

To weather the incoming economic difficulties this year preparation is key. Business owners need to ensure they have sufficient cash flow to make payments on time and still have funds for other operational needs. Here are some strategies you can apply:

- Reassess Business Expenses: Conduct a comprehensive review of all operational costs and identify areas for cost reduction.

- Enhance Financial Planning: Develop realistic financial plans and forecasting for your business to better anticipate potential challenges. It’s crucial to establish contingency plans and reserve funds to address unforeseen circumstances.

- Focus on Customer Retention: Ensure that you maintain strong relationships with existing customers through exceptional customer service. You can also offer loyalty programs and incentives to encourage repeat business.

- Explore New Revenue Streams: Identify any opportunities to diversify your product or service offerings. Consider targeting new markets to expand the business.

- Government Support Programs: Stay informed about government grants and support programs that may assist businesses financially. Look for those that apply to your industry and state.

- Explore Financial Support Options: Businesses can seek loans or lines of credit to help with cash flow and working capital needs. Loans can help cover operational expenses and serve as a financial lifeline in cases of economic downturns.

The Role of Loans in Business Growth and Stability

Accessing credit before your situation becomes dire can be a precautionary strategy to strengthen your business’ ability to withstand an economic downturn.

A line of credit for your business to support cash flow and to act as a buffer in case of unexpected circumstances can assist with work in progress and payroll while you’re waiting to get paid. For an injection of working capital secured and unsecured term loans can boost cash reserves, take care of tax debt and consolidate outstanding accounts.

Look for the Right Form of Credit to Support Your Business in 2024

As a business owner, you are most likely already grappling with the effects of increased interest rates and high inflation; it’s wise to prepare for even more challenging times ahead. Business loans can be a support to bolster your business through an economic downturn. If you're looking for a line of credit or a business loan, talk to a loan expert at Dark Horse Financial.