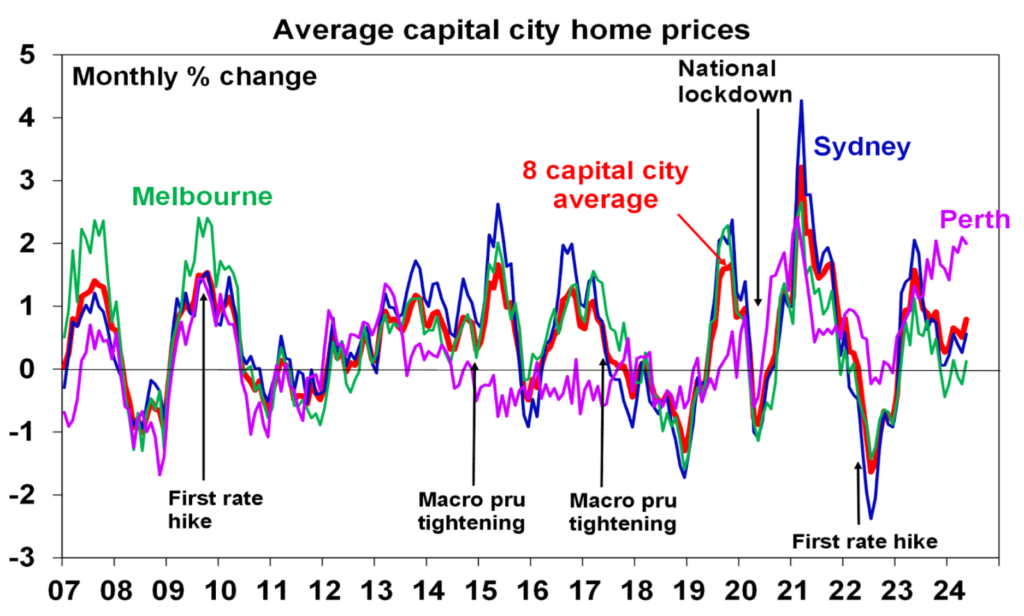

In May 2024, Australian home prices increased by 0.8% according to Corelogic and AMP Chief Economist Shane Oliver, the biggest monthly increase since October last year. This new record high shows how strong the housing market is, despite high interest rates and low sentiment in property.

A shortage of houses and a strong job market have been key reasons for this growth, especially in cities like Perth, Brisbane, and Adelaide, where fewer houses and strong interstate migration have led to significant price increases. As the shortage of houses continues, experts predict a 5% rise in home prices for the year.

However, the market is quite varied. Melbourne and Hobart have more houses for sale in these areas, indicating relative weakness in their housing markets relative to other capital cities.

Housing Supply Crunch to Worsen Before Improving

The housing market faces a serious home shortage that will soon worsen, with high immigration, construction delays, and cautious buyers contributing to the problem.

Surging Immigration Levels

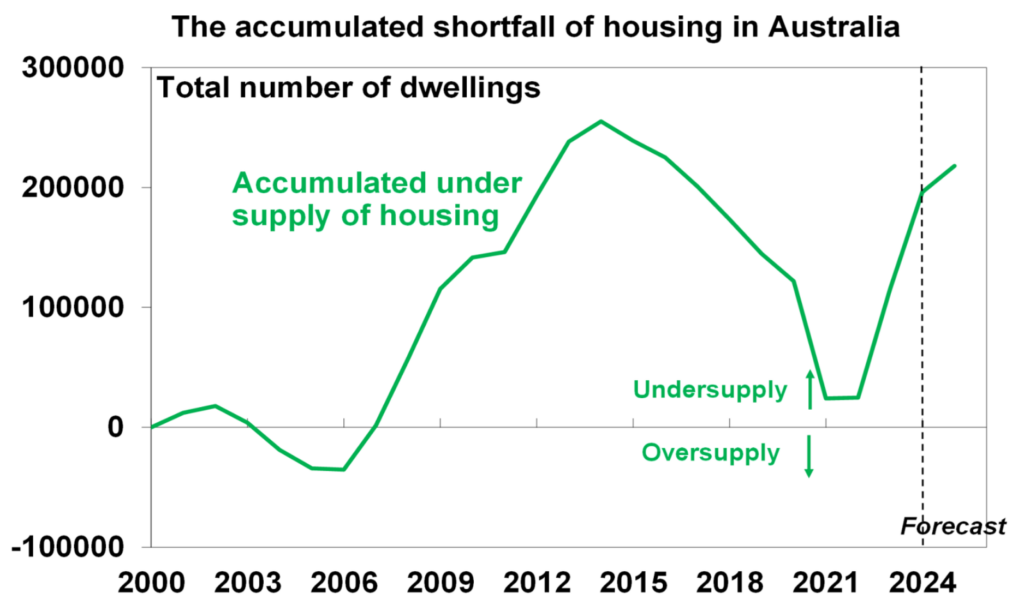

Over 660,000 people moved to Australia over the year to the September quarter last year, worsening the housing shortage. If immigration stays high, it will add more pressure to the already tight housing market.

Delayed Construction

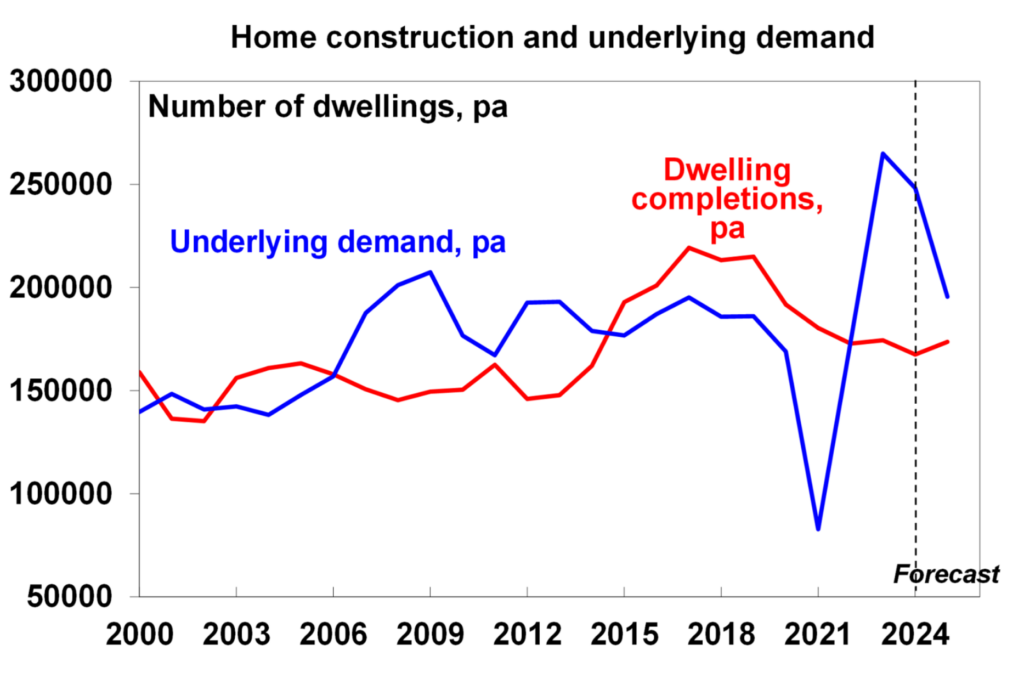

Due to high immigration levels, around 250,000 new homes were needed, but only about 170,000 have been completed resulting in a shortfall of 80,000 homes. The building industry is struggling to keep up chiefly due to rising costs and labour shortages, and lower sentiment means there are fewer approvals to build new homes.

Fewer People per Household

As more households consist of fewer people on average, there is a need for more homes to accommodate everyone. If this trend continues, there could be a shortage of around 300,000 homes. This deficit would surpass the housing stock before the construction surge that started in 2015.

Buyer Hesitancy

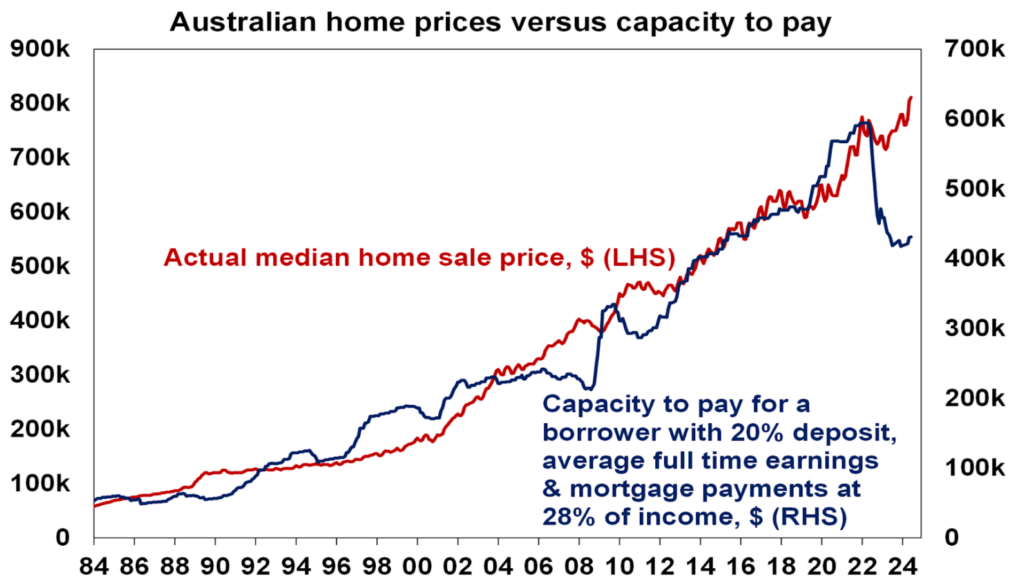

Since May 2022, interest rates have increased, and national average home prices are rising again. This has created a significant gap between buyers’ ability to afford property and home prices. Estimates suggest buyers’ ability to pay has decreased by 27% since April 2022. People might wait to buy houses because interest rates haven’t been cut, and they might go up. This can lead to more distressed listings and fewer houses being put up for sale, making the housing shortage worse.

Home Prices are Significantly Higher than What People Can Afford

High property prices and increasing debt and mortgage rates make it harder for people to afford homes. Lower interest rates used to help keep housing affordable, but since rates started rising again in May 2022, the gap between what buyers can afford and home prices has widened.

The graph illustrates the relationship between Australian home prices and the capacity to pay for those homes from 1984 to 2024. It features two lines:

- The red line (LHS) represents the median home sale price in Australian dollars, which has significantly increased from around $100,000 in the mid-1980s to over $800,000 in recent years.

- The blue line (RHS) indicates the capacity to pay for a borrower with a 20% deposit, based on average full-time earnings and mortgage payments set at 28% of income, which has also increased but at a slower pace, rising from around $100,000 to approximately $600,000.

Regional Variations

Perth, Brisbane, and Adelaide

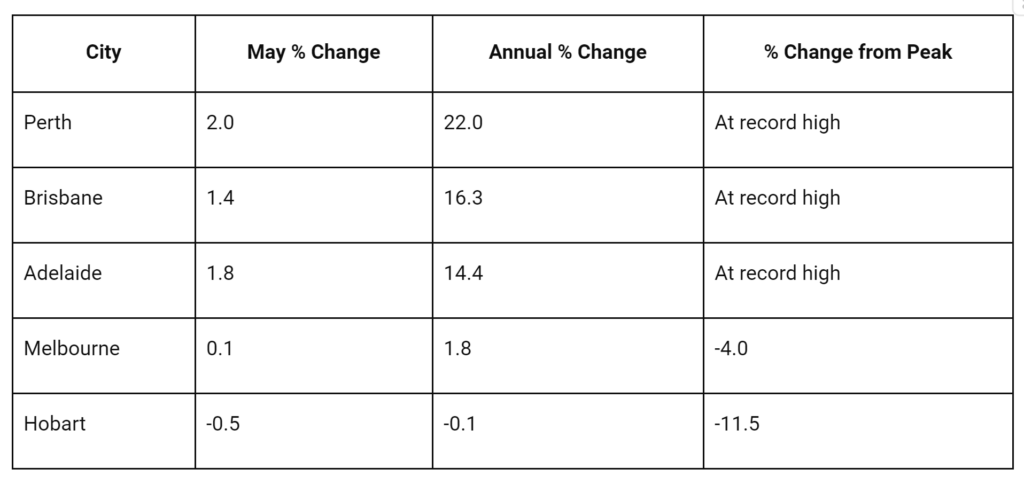

Perth, Brisbane, and Adelaide are experiencing robust growth, with home prices reaching record highs. In May, Perth’s prices increased by 2.0%, Brisbane’s by 1.4%, and Adelaide’s by 1.8%. This is because there aren’t many homes for sale, with the total number of listings being more than 30% lower than usual for these cities. Also, many people are moving from other parts of Australia to Brisbane and Perth. These factors have created a resilient market despite high interest rates and buyers’ poor sentiment towards housing.

Melbourne and Hobart

On the other hand, Melbourne and Hobart are facing some challenges. Melbourne’s home prices increased by 0.1% in May, and they’ve only increased by 1.8% over the year. Hobart saw a decrease of 0.5% in May and a decrease of 0.1% over the year. Both cities have more homes for sale than usual, meaning more supply than demand. This, along with fewer people moving to these cities from other parts of Australia, has made the market softer. Melbourne’s and Hobart’s home prices are still 4% and 11.5% below their highest points, respectively.

Get the Best Deal On Your Mortgage However the Market Moves

With rapidly changing economic conditions, it’s important you review your mortgage every six months to make sure you’re in the best position you can be. If it’s time to elevate your finance conversation, get in touch to talk to an expert.