Key Takeaway Table

| Key Point | Description |

|---|---|

|

Definition

|

Trade and import finance are a line of credit solution for business owners seeking to pay for material supplies. Using a pre-approved line of credit, businesses can use Trade finance to pay for their supplies and have between 60 and 210 days to pay it back.

|

|

Importance of Trade and Import Finance

|

Purchasing material goods internationally is crucial for businesses, but financial hurdles can make it challenging. With this type of financing, businesses can obtain funds for purchasing material supplies without dipping into their cash reserves or straining their cash flow. They can also foster better relationships with overseas suppliers and get access to better and less expensive goods.

|

|

Using Trade and Import Finance to Purchase Equipment

|

Trade and import finance can be used in conjunction with equipment finance to facilitate the purchase of essential machinery and equipment from overseas.

|

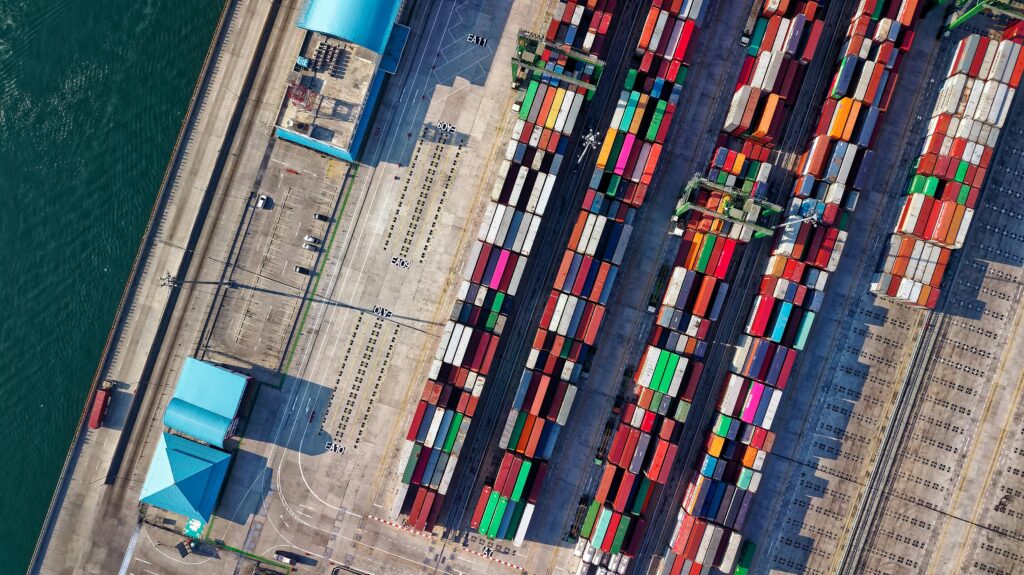

For a lot of businesses, purchasing materials overseas is vital to operations. However, financial barriers can make these international transactions challenging. Trade and import finance can help businesses navigate these financial challenges so they can engage in international trade with greater confidence.

What is Trade and Import Finance?

Trade and import finance refers to a line of credit solution for businesses purchasing material supplies from overseas.

When businesses purchase materials like metals or componentry, they need to produce a large amount of funds, which is not always possible, especially for SMEs. The benefit of trade finance is it allows you to preserve your capital and pay for your material supplies once they’ve been converted into saleable goods and services.

With this type of financing, businesses can use a pre-approved line of credit to pay for materials from overseas suppliers. Depending on the terms of your facility you can have around 60 to 210 days to repay your credit. Banks will usually have longer terms.

Businesses Best Suited for Trade and Import Financing

This type of financing can greatly benefit those in business-to-business (B2B) industries, such as those in manufacturing, construction, retail, or any industry that relies heavily on purchasing material supplies from overseas.

Why is Trade and Import Finance Important?

It gives businesses time to pay suppliers.

- With trade finance, you have anywhere from 60 to 210 days to repay what you borrowed. This timeframe is usually longer than many suppliers’ credit terms. With the features of trade finance, you can ask suppliers for a discount for paying COD or extend your supplier terms by using trade finance at the end of your supplier terms.

It helps businesses foster good relationships with their suppliers.

- Finding and keeping a good relationship with suppliers is crucial for businesses. Paying on time can significantly improve your relationship with overseas suppliers, opening up the possibility for negotiations when it comes to rates and credit terms.

It helps businesses preserve working capital.

- Without financing, businesses will have to pay for large orders of material goods with their cash reserves, which can be quite a heavy expense. With trade and import finance, businesses can use a line of credit to pay for imported goods. Businesses can thus preserve working capital to pay for operational expenses like payroll and utility bills.

It allows businesses to do more than what their cash flow allows.

- Trade and import finance enables businesses to do more, which wouldn’t have been possible if they relied solely on their cash flow. They can purchase more materials or choose suppliers that provide higher-quality goods. They can also expand their products and services.

It gives businesses access to better materials for lower prices.

- In some cases, the right products are found outside of Australia and can be purchased for lower prices, too. Trade and import finance makes it possible to buy a large amount of these higher-quality goods. Doing could help you gain an advantage over competitors.

Using Trade and Import Finance for Equipment Purchases

Although most businesses use trade and import finance for buying raw materials, it is possible to use it for equipment purchases as well. Many essential machinery and equipment are manufactured outside of Australia. For businesses interested in buying them, a line of credit can help cover the large upfront cost. Once the equipment is in Australia and has cleared customs, businesses can then use equipment financing to pay off the line of credit.

Through this method, you use trade and import finance to get the equipment you need into the country. Then, the equipment finance allows you to pay off the cost in a 3 to 5-year term.

How Can We Help?

Dark Horse Financial can help you find the financing you need for your international trading needs. We specialise in tailored solutions, helping you find the best lenders and terms for your specific needs. We’ll help your business reach its full potential through successful trading across different borders. Talk to us today to learn more.